Page 88 - Supplement to 2022 Income Tax

P. 88

Page 25 of 26

11:14 - 16-Dec-2021

Fileid: … -tax-table/2021/a/xml/cycle02/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

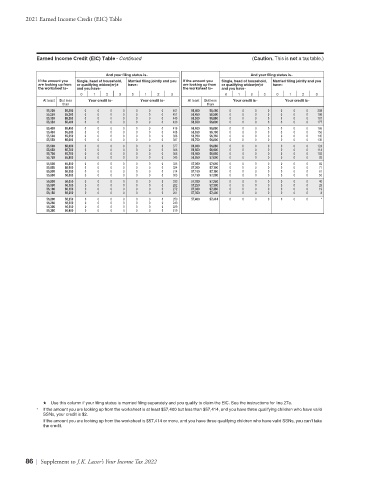

2021 Earned Income Credit (EIC) Table

Earned Income Credit (EIC) Table - Continued (Caution. This is not a tax table.)

And your filing status is– And your filing status is–

If the amount you Single, head of household, Married filing jointly and you If the amount you Single, head of household, Married filing jointly and you

are looking up from or qualifying widow(er)★ have– are looking up from or qualifying widow(er)★ have–

the worksheet is– and you have– the worksheet is– and you have–

0 1 2 3 0 1 2 3 0 1 2 3 0 1 2 3

At least But less Your credit is– Your credit is– At least But less Your credit is– Your credit is–

than than

55,200 55,250 0 0 0 0 0 0 0 461 56,400 56,450 0 0 0 0 0 0 0 208

55,250 55,300 0 0 0 0 0 0 0 451 56,450 56,500 0 0 0 0 0 0 0 198

55,300 55,350 0 0 0 0 0 0 0 440 56,500 56,550 0 0 0 0 0 0 0 187

55,350 55,400 0 0 0 0 0 0 0 430 56,550 56,600 0 0 0 0 0 0 0 177

55,400 55,450 0 0 0 0 0 0 0 419 56,600 56,650 0 0 0 0 0 0 0 166

55,450 55,500 0 0 0 0 0 0 0 408 56,650 56,700 0 0 0 0 0 0 0 156

55,500 55,550 0 0 0 0 0 0 0 398 56,700 56,750 0 0 0 0 0 0 0 145

55,550 55,600 0 0 0 0 0 0 0 387 56,750 56,800 0 0 0 0 0 0 0 135

55,600 55,650 0 0 0 0 0 0 0 377 56,800 56,850 0 0 0 0 0 0 0 124

55,650 55,700 0 0 0 0 0 0 0 366 56,850 56,900 0 0 0 0 0 0 0 114

55,700 55,750 0 0 0 0 0 0 0 356 56,900 56,950 0 0 0 0 0 0 0 103

55,750 55,800 0 0 0 0 0 0 0 345 56,950 57,000 0 0 0 0 0 0 0 93

55,800 55,850 0 0 0 0 0 0 0 335 57,000 57,050 0 0 0 0 0 0 0 82

55,850 55,900 0 0 0 0 0 0 0 324 57,050 57,100 0 0 0 0 0 0 0 71

55,900 55,950 0 0 0 0 0 0 0 314 57,100 57,150 0 0 0 0 0 0 0 61

55,950 56,000 0 0 0 0 0 0 0 303 57,150 57,200 0 0 0 0 0 0 0 50

56,000 56,050 0 0 0 0 0 0 0 293 57,200 57,250 0 0 0 0 0 0 0 40

56,050 56,100 0 0 0 0 0 0 0 282 57,250 57,300 0 0 0 0 0 0 0 29

56,100 56,150 0 0 0 0 0 0 0 272 57,300 57,350 0 0 0 0 0 0 0 19

56,150 56,200 0 0 0 0 0 0 0 261 57,350 57,400 0 0 0 0 0 0 0 8

56,200 56,250 0 0 0 0 0 0 0 250 57,400 57,414 0 0 0 0 0 0 0 *

56,250 56,300 0 0 0 0 0 0 0 240

56,300 56,350 0 0 0 0 0 0 0 229

56,350 56,400 0 0 0 0 0 0 0 219

★ Use this column if your filing status is married filing separately and you qualify to claim the EIC. See the instructions for line 27a.

* If the amount you are looking up from the worksheet is at least $57,400 but less than $57,414, and you have three qualifying children who have valid

SSNs, your credit is $2.

If the amount you are looking up from the worksheet is $57,414 or more, and you have three qualifying children who have valid SSNs, you can’t take

the credit.

86 | Supplement to J.K. Lasser’s Your Income Tax 2022