Page 262 - TaxAdviser_2022

P. 262

INDIVIDUALSTRUSTS & GIFTS

TES,

A

EST

income. Under Sec. 678, a person other of the trust each year, in order to avoid Under Sec. 678, it may be impossible in

than the grantor is treated as the owner annual taxable gifts by the beneficiaries certain situations to cause all the taxable

of any portion of a trust over which under Sec. 2514(e). In most states, the income allocable to an ESBT’s inter-

the person: beneficiaries’ annual withdrawal pow- est in the S corporation to be taxed to

■ Has a power (exercisable solely by ers will not be protected from lawsuits the trust’s beneficiaries. It is, of course,

himself or herself) to vest the corpus against the beneficiaries, but the lapsed impossible for income (including taxable

or the income from the trust in portions of the withdrawal rights will be income) not actually distributed by the

himself or herself; or so protected.8 S corporation to the trust (i.e., in the

■ Has previously partially released or It is doubtful that the income the way of dividends) to be withdrawable by

otherwise modified such a power ESBT beneficiaries do not elect to with- the trust’s beneficiaries. Thus, only the

and subsequently retains control of draw from the trust will be considered ordinary income of the S corporation

the trust that under the grantor trust divisible marital property, not just be- portion of an ESBT is withdrawable.

rules would cause the grantor to be cause it can be argued that it is property If a portion of the taxable income of

treated as the trust’s owner. received by way of inheritance or gift, the S corporation is not distributed to

Under Sec. 678, if the beneficiaries of but primarily because the property is the ESBT (i.e., as a result of working

an ESBT are granted the sole power to not actually owned by the beneficiaries, capital or other needs), and in effect is

withdraw the S corporation income that once the power to withdraw the same therefore allocable to trust corpus, this

is distributed to the trust annually, they has lapsed. Instead, and at best, it would retained taxable income of the S corpo-

are taxed on this trust income at their seem the following provision from the ration will be taxed to the ESBT at the

own tax rates regardless of whether they Uniform Marital Property Act should highest federal income tax rate. If the

withdraw it. An ESBT itself is not taxed apply: “The right to manage and control client’s family controls the S corpora-

on the income of the trust attributable marital property transferred to a trust is tion, one possible workaround to this

to the S corporation to the extent the determined by the trust.”9 situation would be for the S corporation

beneficiaries are taxed under Sec. 678. to first distribute this portion of the

If the beneficiaries of an ESBT are Advantages of a QSST over income to the ESBT and then have the

given withdrawal rights, each benefi- an ESBT trustee of the ESBT voluntarily invest

ciary’s rights should be designed to fully On the other hand, despite their desir- the same back into the corporation.

or partially lapse at the end of each year, able features, ESBTs have some poten- But if the client’s situation is such

but only to the extent of 5% of the value tial disadvantages compared to QSSTs. that this workaround is unavailable

8. For more information on the technical aspects of utilizing Sec. 678, including sample forms, see Blase, 6-7-8: Estate Planning With Section 678 of the Internal

Revenue Code (2022).

9. Uniform Marital Property Act, §5(c).

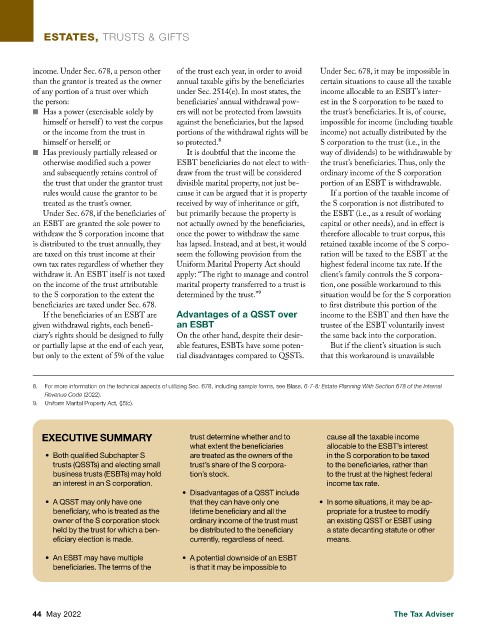

EXECUTIVE SUMMARY trust determine whether and to cause all the taxable income

what extent the beneficiaries allocable to the ESBT’s interest

• Both qualified Subchapter S are treated as the owners of the in the S corporation to be taxed

trusts (QSSTs) and electing small trust’s share of the S corpora- to the beneficiaries, rather than

business trusts (ESBTs) may hold tion’s stock. to the trust at the highest federal

an interest in an S corporation. income tax rate.

• Disadvantages of a QSST include

• A QSST may only have one that they can have only one • In some situations, it may be ap-

beneficiary, who is treated as the lifetime beneficiary and all the propriate for a trustee to modify

owner of the S corporation stock ordinary income of the trust must an existing QSST or ESBT using

held by the trust for which a ben- be distributed to the beneficiary a state decanting statute or other

eficiary election is made. currently, regardless of need. means.

• An ESBT may have multiple • A potential downside of an ESBT

beneficiaries. The terms of the is that it may be impossible to

44 May 2022 The Tax Adviser