Page 295 - TaxAdviser_2022

P. 295

a mutual agreement procedure (MAP)

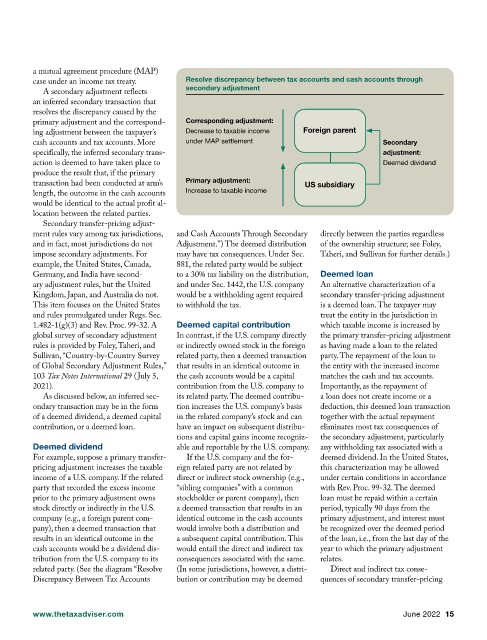

Resolve discrepancy between tax accounts and cash accounts through

case under an income tax treaty.

secondary adjustment

A secondary adjustment reflects

an inferred secondary transaction that

resolves the discrepancy caused by the

primary adjustment and the correspond- Corresponding adjustment:

ing adjustment between the taxpayer’s Decrease to taxable income Foreign parent

cash accounts and tax accounts. More under MAP settlement Secondary

specifically, the inferred secondary trans- adjustment:

action is deemed to have taken place to Deemed dividend

produce the result that, if the primary

Primary adjustment:

transaction had been conducted at arm’s US subsidiary

Increase to taxable income

length, the outcome in the cash accounts

would be identical to the actual profit al-

location between the related parties.

Secondary transfer-pricing adjust-

ment rules vary among tax jurisdictions, and Cash Accounts Through Secondary directly between the parties regardless

and in fact, most jurisdictions do not Adjustment.”) The deemed distribution of the ownership structure; see Foley,

impose secondary adjustments. For may have tax consequences. Under Sec. Taheri, and Sullivan for further details.)

example, the United States, Canada, 881, the related party would be subject

Germany, and India have second- to a 30% tax liability on the distribution, Deemed loan

ary adjustment rules, but the United and under Sec. 1442, the U.S. company An alternative characterization of a

Kingdom, Japan, and Australia do not. would be a withholding agent required secondary transfer-pricing adjustment

This item focuses on the United States to withhold the tax. is a deemed loan. The taxpayer may

and rules promulgated under Regs. Sec. treat the entity in the jurisdiction in

1.482-1(g)(3) and Rev. Proc. 99-32. A Deemed capital contribution which taxable income is increased by

global survey of secondary adjustment In contrast, if the U.S. company directly the primary transfer-pricing adjustment

rules is provided by Foley, Taheri, and or indirectly owned stock in the foreign as having made a loan to the related

Sullivan, “Country-by-Country Survey related party, then a deemed transaction party. The repayment of the loan to

of Global Secondary Adjustment Rules,” that results in an identical outcome in the entity with the increased income

103 Tax Notes International 29 (July 5, the cash accounts would be a capital matches the cash and tax accounts.

2021). contribution from the U.S. company to Importantly, as the repayment of

As discussed below, an inferred sec- its related party. The deemed contribu- a loan does not create income or a

ondary transaction may be in the form tion increases the U.S. company’s basis deduction, this deemed loan transaction

of a deemed dividend, a deemed capital in the related company’s stock and can together with the actual repayment

contribution, or a deemed loan. have an impact on subsequent distribu- eliminates most tax consequences of

tions and capital gains income recogniz- the secondary adjustment, particularly

Deemed dividend able and reportable by the U.S. company. any withholding tax associated with a

For example, suppose a primary transfer- If the U.S. company and the for- deemed dividend. In the United States,

pricing adjustment increases the taxable eign related party are not related by this characterization may be allowed

income of a U.S. company. If the related direct or indirect stock ownership (e.g., under certain conditions in accordance

party that recorded the excess income “sibling companies” with a common with Rev. Proc. 99-32. The deemed

prior to the primary adjustment owns stockholder or parent company), then loan must be repaid within a certain

stock directly or indirectly in the U.S. a deemed transaction that results in an period, typically 90 days from the

company (e.g., a foreign parent com- identical outcome in the cash accounts primary adjustment, and interest must

pany), then a deemed transaction that would involve both a distribution and be recognized over the deemed period

results in an identical outcome in the a subsequent capital contribution. This of the loan, i.e., from the last day of the

cash accounts would be a dividend dis- would entail the direct and indirect tax year to which the primary adjustment

tribution from the U.S. company to its consequences associated with the same. relates.

related party. (See the diagram “Resolve (In some jurisdictions, however, a distri- Direct and indirect tax conse-

Discrepancy Between Tax Accounts bution or contribution may be deemed quences of secondary transfer-pricing

www.thetaxadviser.com June 2022 15