Page 296 - TaxAdviser_2022

P. 296

TAX CLINIC

begins with the opening conference

Resolve discrepancy between tax accounts and cash accounts through between the taxpayer and the examina-

cash repatriation tion team and thus does not include the

planning and risk assessment work that

the IRS exam team must do prior to

Corresponding adjustment: meeting with the taxpayer. Exam teams

Decrease to taxable income Foreign parent are not bound to the timeline — conten-

under MAP settlement tious IRS transfer-pricing audits can

Cash repatriation take much longer.

MAP can be requested as soon as

the IRS has issued a notice of proposed

Primary adjustment: US subsidiary adjustment (NOPA), but many taxpay-

Increase to taxable income ers wish to explore resolution options

with the IRS before proceeding to MAP.

When doing so, it is crucial to consider

Rev. Proc. 2015-40’s rules on coordina-

adjustments may be different depending Transfer pricing and MAP: tion with IRS examination and the IRS

on the jurisdiction of the related party, Common traps for the unwary Independent Office of Appeals.

any applicable income tax treaties, or Transfer-pricing disputes have a ten- The Appeals coordination rules pose

mutual agreements. The introduction of dency to protract themselves over a a serious trap for the unwary. Historical-

the U.S. participation exemption system number of years and discrete stages. For ly, taxpayers were able to go through the

as part of the law known as the Tax one thing, the uncertainties inherent in IRS Appeals process before proceeding

Cuts and Jobs Act, P.L. 115-97, may in questions of valuation and the highly to MAP, and many opted to do so. Since

certain cases mitigate adverse effects of factual nature of transfer-pricing inqui- the adoption of Rev. Proc. 2015-40, the

secondary transfer-pricing adjustments. ries lend themselves to a lengthy process. ability to obtain Appeals consideration

For instance, Sec. 245A may allow U.S. For another, the intrinsically bilateral or of an issue before seeking MAP relief

corporations to deduct 100% of divi- multilateral nature of a transfer-pricing has been severely curtailed. The U.S.

dends received from 10%-owned foreign adjustment means that transfer-pricing competent authority will no longer

corporations other than passive foreign disputes are frequently resolved via the consider issues that have been under

investment companies. As a result, when mutual agreement procedure (MAP) Appeals’ jurisdiction unless the MAP

the participation exemption applies, U.S. under an applicable bilateral tax treaty. request is filed within 60 days following

taxpayers may be able to avoid income Where available, MAP is an attrac- the Appeals opening conference, and

tax on the inbound deemed dividend tive option: Statistics from the Organ- then only if the taxpayer demonstrates

or a subsequent repatriation of the out- isation for Economic Co-operation and that the MAP issues have been severed

bound deemed capital contribution. Development (OECD) demonstrate from any issues that remain under Ap-

Secondary adjustments are a that MAP with most major U.S. treaty peals consideration. However, Rev. Proc.

highly technical and nonintuitive area partners is very successful at eliminating 2015-40 does provide a simultaneous

of transfer pricing. In the United States, double taxation. However, there are a appeals procedure through which a tax-

transfer-pricing adjustments typically number of pitfalls that beset taxpayers payer can obtain Appeals consideration

create secondary adjustments. Taxpayers seeking to access MAP and to imple- of issues under the competent author-

need to know about these secondary ment MAP resolutions. This item ity’s jurisdiction.

adjustments, understand the tax conse- reviews some of the most common traps

quences, and consider possible planning for the unwary. Minding the treaty

opportunities, including those involving Just like IRS examinations, foreign

repatriation under Rev. Proc. 99-32. (See Navigating the road map transfer-pricing audits can take many

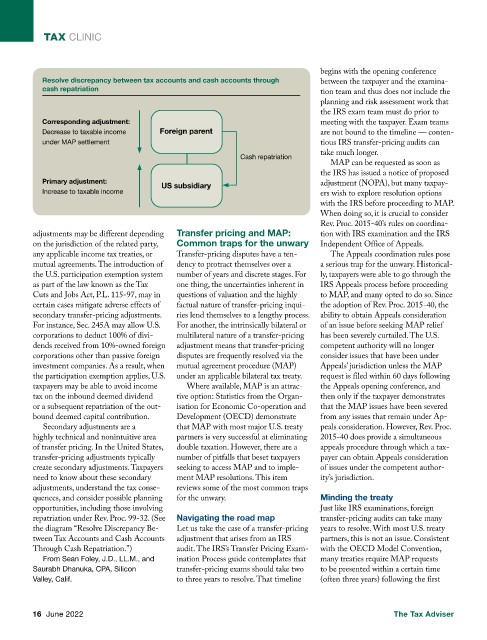

the diagram “Resolve Discrepancy Be- Let us take the case of a transfer-pricing years to resolve. With most U.S. treaty

tween Tax Accounts and Cash Accounts adjustment that arises from an IRS partners, this is not an issue. Consistent

Through Cash Repatriation.”) audit. The IRS’s Transfer Pricing Exam- with the OECD Model Convention,

From Sean Foley, J.D., LL.M., and ination Process guide contemplates that many treaties require MAP requests

Saurabh Dhanuka, CPA, Silicon transfer-pricing exams should take two to be presented within a certain time

Valley, Calif. to three years to resolve. That timeline (often three years) following the first

16 June 2022 The Tax Adviser