Page 366 - TaxAdviser_2022

P. 366

with the Sec. 267(c)(4) constructive

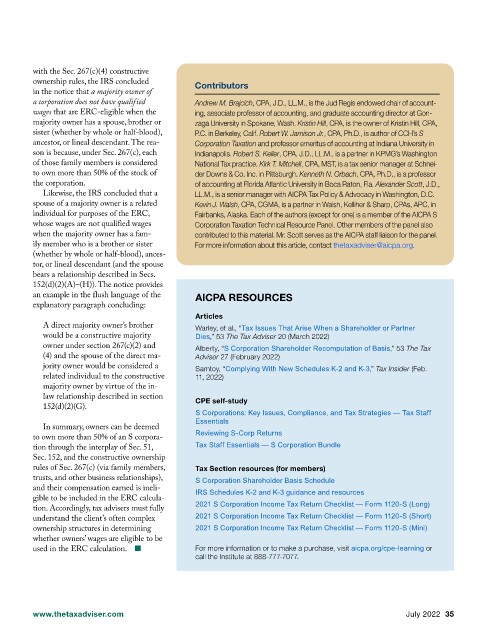

ownership rules, the IRS concluded Contributors

in the notice that a majority owner of

a corporation does not have qualified Andrew M. Brajcich, CPA, J.D., LL.M., is the Jud Regis endowed chair of account-

wages that are ERC-eligible when the ing, associate professor of accounting, and graduate accounting director at Gon-

majority owner has a spouse, brother or zaga University in Spokane, Wash. Kristin Hill, CPA, is the owner of Kristin Hill, CPA,

sister (whether by whole or half-blood), P.C. in Berkeley, Calif. Robert W. Jamison Jr., CPA, Ph.D., is author of CCH’s S

ancestor, or lineal descendant. The rea- Corporation Taxation and professor emeritus of accounting at Indiana University in

son is because, under Sec. 267(c), each Indianapolis. Robert S. Keller, CPA, J.D., LL.M., is a partner in KPMG’s Washington

of those family members is considered National Tax practice. Kirk T. Mitchell, CPA, MST, is a tax senior manager at Schnei-

to own more than 50% of the stock of der Downs & Co. Inc. in Pittsburgh. Kenneth N. Orbach, CPA, Ph.D., is a professor

the corporation. of accounting at Florida Atlantic University in Boca Raton, Fla. Alexander Scott, J.D.,

Likewise, the IRS concluded that a LL.M., is a senior manager with AICPA Tax Policy & Advocacy in Washington, D.C.

spouse of a majority owner is a related Kevin J. Walsh, CPA, CGMA, is a partner in Walsh, Kelliher & Sharp, CPAs, APC, in

individual for purposes of the ERC, Fairbanks, Alaska. Each of the authors (except for one) is a member of the AICPA S

whose wages are not qualified wages Corporation Taxation Technical Resource Panel. Other members of the panel also

when the majority owner has a fam- contributed to this material. Mr. Scott serves as the AICPA staff liaison for the panel.

ily member who is a brother or sister For more information about this article, contact thetaxadviser@aicpa.org.

(whether by whole or half-blood), ances-

tor, or lineal descendant (and the spouse

bears a relationship described in Secs.

152(d)(2)(A)–(H)). The notice provides

an example in the flush language of the AICPA RESOURCES

explanatory paragraph concluding:

Articles

A direct majority owner’s brother Warley, et al., “Tax Issues That Arise When a Shareholder or Partner

would be a constructive majority Dies,” 53 The Tax Adviser 20 (March 2022)

owner under section 267(c)(2) and Alberty, “S Corporation Shareholder Recomputation of Basis,” 53 The Tax

(4) and the spouse of the direct ma- Adviser 27 (February 2022)

jority owner would be considered a Samtoy, “Complying With New Schedules K-2 and K-3,” Tax Insider (Feb.

related individual to the constructive 11, 2022)

majority owner by virtue of the in-

law relationship described in section

CPE self-study

152(d)(2)(G).

S Corporations: Key Issues, Compliance, and Tax Strategies — Tax Staff

Essentials

In summary, owners can be deemed

Reviewing S-Corp Returns

to own more than 50% of an S corpora-

Tax Staff Essentials — S Corporation Bundle

tion through the interplay of Sec. 51,

Sec. 152, and the constructive ownership

rules of Sec. 267(c) (via family members, Tax Section resources (for members)

trusts, and other business relationships), S Corporation Shareholder Basis Schedule

and their compensation earned is ineli-

IRS Schedules K-2 and K-3 guidance and resources

gible to be included in the ERC calcula-

2021 S Corporation Income Tax Return Checklist — Form 1120-S (Long)

tion. Accordingly, tax advisers must fully

2021 S Corporation Income Tax Return Checklist — Form 1120-S (Short)

understand the client’s often complex

ownership structures in determining 2021 S Corporation Income Tax Return Checklist — Form 1120-S (Mini)

whether owners’ wages are eligible to be

used in the ERC calculation. ■ For more information or to make a purchase, visit aicpa.org/cpe-learning or

call the Institute at 888-777-7077.

www.thetaxadviser.com July 2022 35