Page 392 - TaxAdviser_2022

P. 392

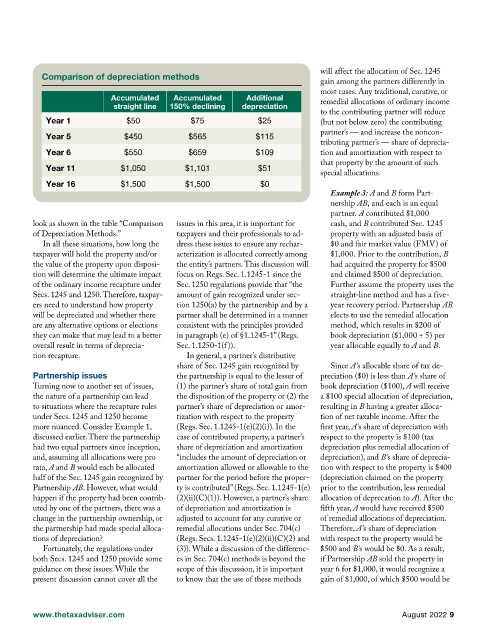

Comparison of depreciation methods will affect the allocation of Sec. 1245

gain among the partners differently in

most cases. Any traditional, curative, or

Accumulated Accumulated Additional

straight line 150% declining depreciation remedial allocations of ordinary income

to the contributing partner will reduce

Year 1 $50 $75 $25 (but not below zero) the contributing

Year 5 $450 $565 $115 partner’s — and increase the noncon-

tributing partner’s — share of deprecia-

Year 6 $550 $659 $109 tion and amortization with respect to

Year 11 $1,050 $1,101 $51 that property by the amount of such

special allocations.

Year 16 $1,500 $1,500 $0

Example 3: A and B form Part-

nership AB, and each is an equal

partner. A contributed $1,000

look as shown in the table “Comparison issues in this area, it is important for cash, and B contributed Sec. 1245

of Depreciation Methods.” taxpayers and their professionals to ad- property with an adjusted basis of

In all these situations, how long the dress these issues to ensure any rechar- $0 and fair market value (FMV) of

taxpayer will hold the property and/or acterization is allocated correctly among $1,000. Prior to the contribution, B

the value of the property upon disposi- the entity’s partners. This discussion will had acquired the property for $500

tion will determine the ultimate impact focus on Regs. Sec. 1.1245-1 since the and claimed $500 of depreciation.

of the ordinary income recapture under Sec. 1250 regulations provide that “the Further assume the property uses the

Secs. 1245 and 1250. Therefore, taxpay- amount of gain recognized under sec- straight-line method and has a five-

ers need to understand how property tion 1250(a) by the partnership and by a year recovery period. Partnership AB

will be depreciated and whether there partner shall be determined in a manner elects to use the remedial allocation

are any alternative options or elections consistent with the principles provided method, which results in $200 of

they can make that may lead to a better in paragraph (e) of §1.1245-1” (Regs. book depreciation ($1,000 ÷ 5) per

overall result in terms of deprecia- Sec. 1.1250-1(f)). year allocable equally to A and B.

tion recapture. In general, a partner’s distributive

share of Sec. 1245 gain recognized by Since A’s allocable share of tax de-

Partnership issues the partnership is equal to the lesser of preciation ($0) is less than A’s share of

Turning now to another set of issues, (1) the partner’s share of total gain from book depreciation ($100), A will receive

the nature of a partnership can lead the disposition of the property or (2) the a $100 special allocation of depreciation,

to situations where the recapture rules partner’s share of depreciation or amor- resulting in B having a greater alloca-

under Secs. 1245 and 1250 become tization with respect to the property tion of net taxable income. After the

more nuanced. Consider Example 1, (Regs. Sec. 1.1245-1(e)(2)(i)). In the first year, A’s share of depreciation with

discussed earlier. There the partnership case of contributed property, a partner’s respect to the property is $100 (tax

had two equal partners since inception, share of depreciation and amortization depreciation plus remedial allocation of

and, assuming all allocations were pro “includes the amount of depreciation or depreciation), and B’s share of deprecia-

rata, A and B would each be allocated amortization allowed or allowable to the tion with respect to the property is $400

half of the Sec. 1245 gain recognized by partner for the period before the proper- (depreciation claimed on the property

Partnership AB. However, what would ty is contributed” (Regs. Sec. 1.1245-1(e) prior to the contribution, less remedial

happen if the property had been contrib- (2)(ii)(C)(1)). However, a partner’s share allocation of deprecation to A). After the

uted by one of the partners, there was a of depreciation and amortization is fifth year, A would have received $500

change in the partnership ownership, or adjusted to account for any curative or of remedial allocations of depreciation.

the partnership had made special alloca- remedial allocations under Sec. 704(c) Therefore, A’s share of depreciation

tions of depreciation? (Regs. Secs. 1.1245-1(e)(2)(ii)(C)(2) and with respect to the property would be

Fortunately, the regulations under (3)). While a discussion of the differenc- $500 and B’s would be $0. As a result,

both Secs. 1245 and 1250 provide some es in Sec. 704(c) methods is beyond the if Partnership AB sold the property in

guidance on these issues. While the scope of this discussion, it is important year 6 for $1,000, it would recognize a

present discussion cannot cover all the to know that the use of these methods gain of $1,000, of which $500 would be

www.thetaxadviser.com August 2022 9