Page 5 - TaxAdviser_2022

P. 5

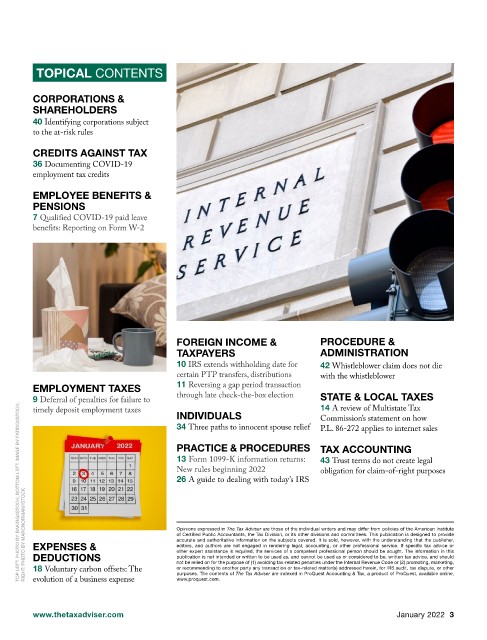

TOPICAL CONTENTS

CORPORATIONS &

SHAREHOLDERS

40 Identifying corporations subject

to the at-risk rules

CREDITS AGAINST TAX

36 Documenting COVID-19

employment tax credits

EMPLOYEE BENEFITS &

PENSIONS

7 Qualified COVID-19 paid leave

benefits: Reporting on Form W-2

FOREIGN INCOME & PROCEDURE &

TAXPAYERS ADMINISTRATION

10 IRS extends withholding date for 42 Whistleblower claim does not die

certain PTP transfers, distributions with the whistleblower

EMPLOYMENT TAXES 11 Reversing a gap period transaction

through late check-the-box election STATE & LOCAL TAXES

9 Deferral of penalties for failure to

TOP LEFT: PHOTO BY BAKIBG/ISTOCK; BOTTOM LEFT: IMAGE BY FATIDO/ISTOCK;

timely deposit employment taxes 14 A review of Multistate Tax

INDIVIDUALS Commission’s statement on how

34 Three paths to innocent spouse relief P.L. 86-272 applies to internet sales

PRACTICE & PROCEDURES TAX ACCOUNTING

13 Form 1099-K information returns: 43 Trust terms do not create legal

New rules beginning 2022 obligation for claim-of-right purposes

26 A guide to dealing with today’s IRS

RIGHT: PHOTO BY MARCNORMAN/ISTOCK EXPENSES & Opinions expressed in The Tax Adviser are those of the individual writers and may differ from policies of the American Institute

of Certified Public Accountants, the Tax Division, or its other divisions and committees. This publication is designed to provide

accurate and authoritative information on the subjects covered. It is sold, however, with the understanding that the publisher,

editors, and authors are not engaged in rendering legal, accounting, or other professional service. If specific tax advice or

other expert assistance is required, the services of a competent professional person should be sought. The information in this

DEDUCTIONS

publication is not intended or written to be used as, and cannot be used as or considered to be, written tax advice, and should

not be relied on for the purpose of (1) avoiding tax-related penalties under the Internal Revenue Code or (2) promoting, marketing,

or recommending to another party any transaction or tax-related matter(s) addressed herein, for IRS audit, tax dispute, or other

18 Voluntary carbon offsets: The

purposes. The contents of The Tax Adviser are indexed in ProQuest Accounting & Tax, a product of ProQuest, available online,

evolution of a business expense

www.thetaxadviser.com www.proquest.com. January 2022 3