Page 57 - Withholding Taxes for Foreign Entities

P. 57

10:50 - 14-Feb-2020

Page 55 of 55

Fileid: … tions/P515/2020/A/XML/Cycle10/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

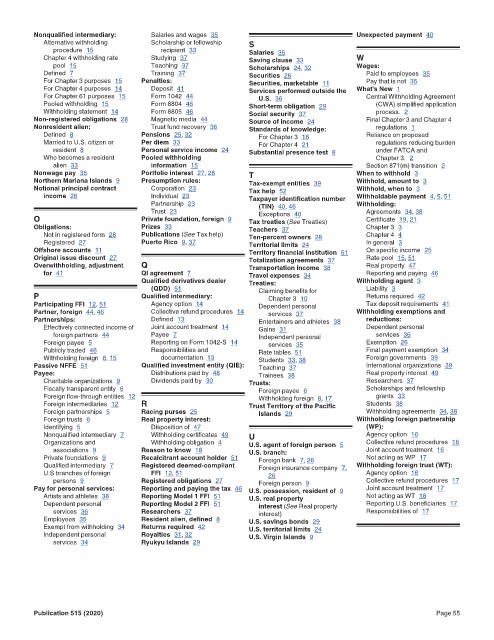

Nonqualified intermediary: Salaries and wages 35 Unexpected payment 40

Alternative withholding Scholarship or fellowship S

procedure 15 recipient 33 Salaries 35

Chapter 4 withholding rate Studying 37 Saving clause 33 W

pool 15 Teaching 37 Scholarships 24, 32 Wages:

Defined 7 Training 37 Securities 26 Paid to employees 35

For Chapter 3 purposes 15 Penalties: Securities, marketable 11 Pay that is not 35

For Chapter 4 purposes 14 Deposit 41 Services performed outside the What's New 1

For Chapter 61 purposes 15 Form 1042 44 U.S. 36 Central Withholding Agreement

Pooled withholding 15 Form 8804 46 Short-term obligation 29 (CWA) simplified application

Withholding statement 14 Form 8805 46 Social security 37 process. 2

Non-registered obligations 28 Magnetic media 44 Source of income 24 Final Chapter 3 and Chapter 4

Nonresident alien: Trust fund recovery 36 Standards of knowledge: regulations 1

Defined 8 Pensions 25, 32 For Chapter 3 18 Reliance on proposed

Married to U.S. citizen or Per diem 33 For Chapter 4 21 regulations reducing burden

resident 8 Personal service income 24 Substantial presence test 8 under FATCA and

Who becomes a resident Pooled withholding Chapter 3. 2

alien 33 information 15 Section 871(m) transition 2

Nonwage pay 35 Portfolio interest 27, 28 T When to withhold 3

Northern Mariana Islands 9 Presumption rules: Tax-exempt entities 39 Withhold, amount to 3

Notional principal contract Corporation 23 Tax help 52 Withhold, when to 3

income 26 Individual 23 Taxpayer identification number Withholdable payment 4, 5, 51

Partnership 23 (TIN) 40, 46 Withholding:

Trust 23 Exceptions 40 Agreements 34, 38

O Private foundation, foreign 9 Tax treaties (See Treaties) Certificate 19, 21

Obligations: Prizes 33 Teachers 37 Chapter 3 3

Not in registered form 28 Publications (See Tax help) Ten-percent owners 28 Chapter 4 4

Registered 27 Puerto Rico 9, 37 Territorial limits 24 In general 3

Offshore accounts 11 Territory financial institution 51 On specific income 25

Original issue discount 27 Totalization agreements 37 Rate pool 15, 51

Overwithholding, adjustment Q Transportation income 38 Real property 47

for 41 QI agreement 7 Travel expenses 34 Reporting and paying 46

Qualified derivatives dealer Treaties: Withholding agent 3

(QDD) 51 Claiming benefits for Liability 3

P Qualified intermediary: Chapter 3 10 Returns required 42

Participating FFI 12, 51 Agency option 14 Dependent personal Tax deposit requirements 41

Partner, foreign 44, 46 Collective refund procedures 14 services 37 Withholding exemptions and

Partnerships: Defined 13 Entertainers and athletes 38 reductions:

Effectively connected income of Joint account treatment 14 Gains 31 Dependent personal

foreign partners 44 Payee 7 Independent personal services 36

Foreign payee 5 Reporting on Form 1042-S 14 services 35 Exemption 26

Publicly traded 46 Responsibilities and Rate tables 51 Final payment exemption 34

Withholding foreign 8, 15 documentation 13 Students 33, 38 Foreign governments 39

Passive NFFE 51 Qualified investment entity (QIE): Teaching 37 International organizations 39

Payee: Distributions paid by 48 Trainees 38 Real property interest 49

Charitable organizations 9 Dividends paid by 30 Trusts: Researchers 37

Fiscally transparent entity 6 Foreign payee 6 Scholarships and fellowship

Foreign flow-through entities 12 Withholding foreign 8, 17 grants 33

Foreign intermediaries 12 R Trust Territory of the Pacific Students 38

Foreign partnerships 5 Racing purses 25 Islands 29 Withholding agreements 34, 38

Foreign trusts 6 Real property interest: Withholding foreign partnership

Identifying 5 Disposition of 47 (WP):

Nonqualified intermediary 7 Withholding certificates 49 U Agency option 16

Organizations and Withholding obligation 4 U.S. agent of foreign person 5 Collective refund procedures 16

associations 9 Reason to know 18 U.S. branch: Joint account treatment 16

Private foundations 9 Recalcitrant account holder 51 Foreign bank 7, 26 Not acting as WP 17

Qualified intermediary 7 Registered deemed-compliant Foreign insurance company 7, Withholding foreign trust (WT):

U.S branches of foreign FFI 12, 51 26 Agency option 18

persons 9 Registered obligations 27 Foreign person 9 Collective refund procedures 17

Pay for personal services: Reporting and paying the tax 46 U.S. possession, resident of 9 Joint account treatment 17

Artists and athletes 38 Reporting Model 1 FFI 51 U.S. real property Not acting as WT 18

Dependent personal Reporting Model 2 FFI 51 interest (See Real property Reporting U.S. beneficiaries 17

services 36 Researchers 37 interest) Responsibilities of 17

Employees 35 Resident alien, defined 8 U.S. savings bonds 29

Exempt from withholding 34 Returns required 42 U.S. territorial limits 24

Independent personal Royalties 31, 32 U.S. Virgin Islands 9

services 34 Ryukyu Islands 29

Publication 515 (2020) Page 55