Page 56 - Withholding Taxes for Foreign Entities

P. 56

10:50 - 14-Feb-2020

Page 54 of 55

Fileid: … tions/P515/2020/A/XML/Cycle10/source

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

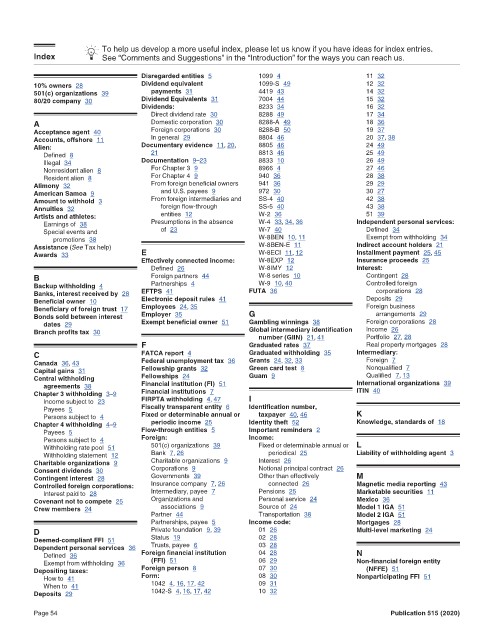

To help us develop a more useful index, please let us know if you have ideas for index entries.

Index See “Comments and Suggestions” in the “Introduction” for the ways you can reach us.

Disregarded entities 5 1099 4 11 32

10% owners 28 Dividend equivalent 1099-S 49 12 32

501(c) organizations 39 payments 31 4419 43 14 32

80/20 company 30 Dividend Equivalents 31 7004 44 15 32

Dividends: 8233 34 16 32

Direct dividend rate 30 8288 49 17 34

A Domestic corporation 30 8288-A 49 18 36

Acceptance agent 40 Foreign corporations 30 8288-B 50 19 37

Accounts, offshore 11 In general 29 8804 46 20 37, 38

Alien: Documentary evidence 11, 20, 8805 46 24 49

Defined 8 21 8813 46 25 49

Illegal 34 Documentation 9–23 8833 10 26 49

Nonresident alien 8 For Chapter 3 9 8966 4 27 46

Resident alien 8 For Chapter 4 9 940 36 28 38

Alimony 32 From foreign beneficial owners 941 36 29 29

American Samoa 9 and U.S. payees 9 972 30 30 27

Amount to withhold 3 From foreign intermediaries and SS-4 40 42 38

Annuities 32 foreign flow-through SS-5 40 43 38

Artists and athletes: entities 12 W-2 36 51 39

Earnings of 38 Presumptions in the absence W-4 33, 34, 36 Independent personal services:

Special events and of 23 W-7 40 Defined 34

promotions 38 W-8BEN 10, 11 Exempt from withholding 34

Assistance (See Tax help) W-8BEN-E 11 Indirect account holders 21

Awards 33 E W-8ECI 11, 12 Installment payment 25, 45

Effectively connected income: W-8EXP 12 Insurance proceeds 25

Defined 26 W-8IMY 12 Interest:

B Foreign partners 44 W-8 series 10 Contingent 28

Backup withholding 4 Partnerships 4 W-9 10, 40 Controlled foreign

Banks, interest received by 28 EFTPS 41 FUTA 36 corporations 28

Beneficial owner 10 Electronic deposit rules 41 Deposits 29

Beneficiary of foreign trust 17 Employees 24, 35 Foreign business

Bonds sold between interest Employer 35 G arrangements 29

dates 29 Exempt beneficial owner 51 Gambling winnings 38 Foreign corporations 28

Branch profits tax 30 Global intermediary identification Income 26

Portfolio 27, 28

number (GIIN) 21, 41

F Graduated rates 37 Real property mortgages 28

C FATCA report 4 Graduated withholding 35 Intermediary:

Canada 36, 43 Federal unemployment tax 36 Grants 24, 32, 33 Foreign 7

Capital gains 31 Fellowship grants 32 Green card test 8 Nonqualified 7

Central withholding Fellowships 24 Guam 9 Qualified 7, 13

agreements 38 Financial institution (FI) 51 International organizations 39

Chapter 3 withholding 3–9 Financial institutions 7 ITIN 40

Income subject to 23 FIRPTA withholding 4, 47 I

Payees 5 Fiscally transparent entity 6 Identification number,

Persons subject to 4 Fixed or determinable annual or taxpayer 40, 46 K

Chapter 4 withholding 4–9 periodic income 25 Identity theft 52 Knowledge, standards of 18

Payees 5 Flow-through entities 5 Important reminders 2

Persons subject to 4 Foreign: Income:

Withholding rate pool 51 501(c) organizations 39 Fixed or determinable annual or L

Withholding statement 12 Bank 7, 26 periodical 25 Liability of withholding agent 3

Charitable organizations 9 Charitable organizations 9 Interest 26

Consent dividends 30 Corporations 9 Notional principal contract 26

Contingent interest 28 Governments 39 Other than effectively M

Controlled foreign corporations: Insurance company 7, 26 connected 26 Magnetic media reporting 43

Interest paid to 28 Intermediary, payee 7 Pensions 25 Marketable securities 11

Covenant not to compete 25 Organizations and Personal service 24 Mexico 36

Crew members 24 associations 9 Source of 24 Model 1 IGA 51

Partner 44 Transportation 38 Model 2 IGA 51

Partnerships, payee 5 Income code: Mortgages 28

D Private foundation 9, 39 01 26 Multi-level marketing 24

Deemed-compliant FFI 51 Status 19 02 28

Dependent personal services 36 Trusts, payee 6 03 28

Defined 36 Foreign financial institution 04 28 N

Exempt from withholding 36 (FFI) 51 06 29 Non-financial foreign entity

Depositing taxes: Foreign person 8 07 30 (NFFE) 51

How to 41 Form: 08 30 Nonparticipating FFI 51

When to 41 1042 4, 16, 17, 42 09 31

Deposits 29 1042-S 4, 16, 17, 42 10 32

Page 54 Publication 515 (2020)