Page 17 - Large Business IRS Training Guides

P. 17

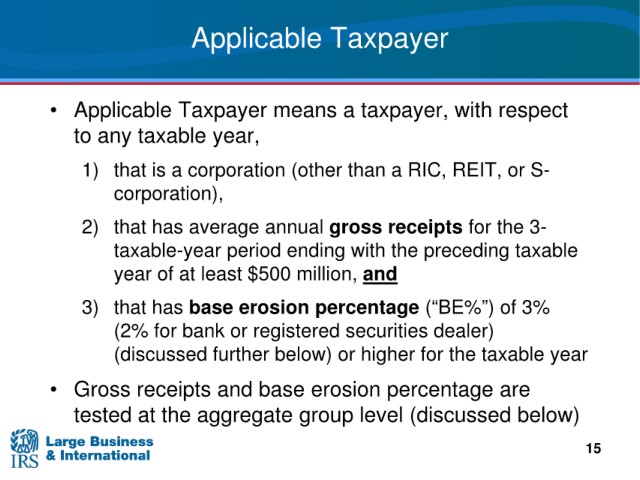

Applicable Taxpayer

means a taxpayer, with respect

• Applicable Taxpayer

taxable year,

to any

than a RIC, REIT, or S-

1) that is a corporation (other

corporation),

2) that has average annual gross receipts for the 3

taxable-year period ending with the preceding taxable

year of at least $500 million, and

base erosion percentage (“BE%”) of 3%

3) that has

(2% for

bank or registered securities dealer)

for the taxable year

(discussed further below) or higher

• Gross

receipts and base erosion percentage are

tested at the aggregate group level

(discussed below)

15