Page 21 - Large Business IRS Training Guides

P. 21

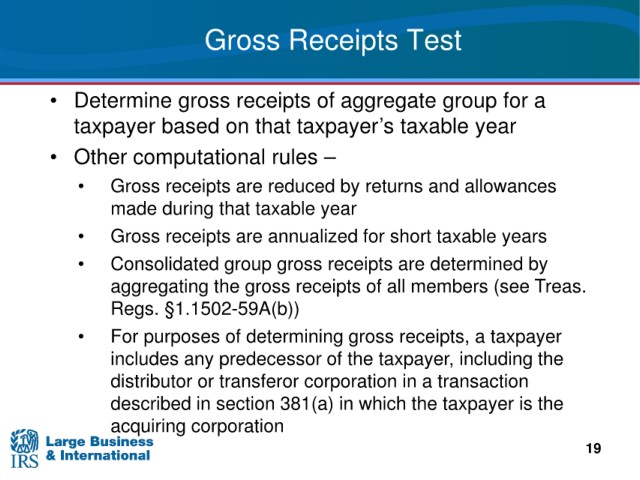

Gross Receipts

Test

• Determine gross

receipts of aggregate group for a

taxpayer based on that

taxpayer’s taxable year

rules –

• Other computational

• Gross receipts

are reduced by returns and allowances

taxable year

made during that

are annualized for short taxable years

• Gross receipts

receipts are determined by

• Consolidated group gross

aggregating the gross

receipts of all members (see Treas.

§1.1502-59A(b))

Regs.

determining gross receipts, a taxpayer

• For purposes of

includes

any predecessor of the taxpayer, including the

distributor or transferor corporation in a transaction

the

described in section 381(a) in which the taxpayer is

acquiring corporation

19