Page 29 - Large Business IRS Training Guides

P. 29

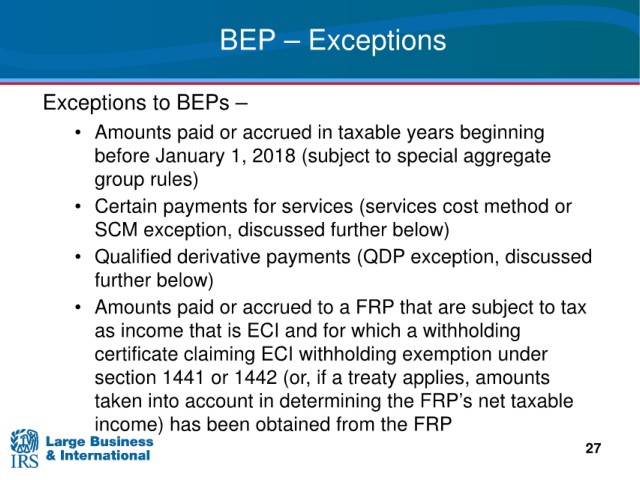

BEP – Exceptions

Exceptions

to BEPs –

• Amounts paid or accrued in taxable years beginning

aggregate

before January 1, 2018 (subject to special

group rules)

• Certain payments

for services (services cost method or

SCM exception, discussed further below)

(QDP exception, discussed

• Qualified derivative payments

further below)

paid or accrued to a FRP that are subject to tax

• Amounts

as income that is

ECI and for which a withholding

certificate claiming ECI withholding exemption under

section 1441 or

1442 (or, if a treaty applies, amounts

taken into account in determining the FRP’s net taxable

income) has

been obtained from the FRP

27