Page 33 - Large Business IRS Training Guides

P. 33

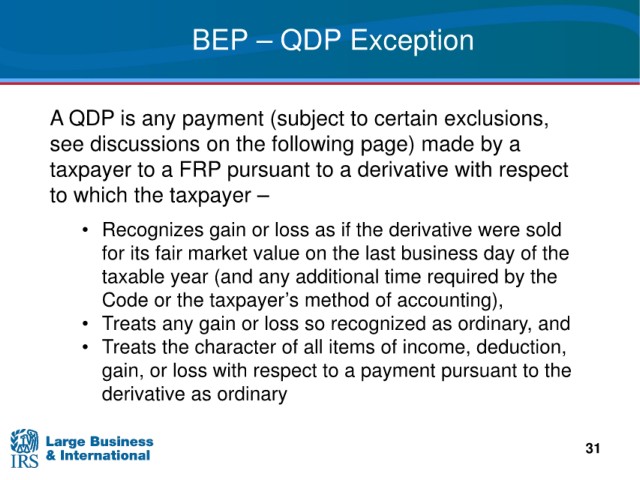

BEP – QDP

Exception

A QDP is any payment (subject to certain exclusions,

on the following page) made by a

see discussions

to a derivative with respect

taxpayer to a FRP pursuant

to which the taxpayer

–

• Recognizes

gain or loss as if the derivative were sold

for

its fair market value on the last business day of the

time required by the

taxable year (and any additional

method of accounting),

Code or the taxpayer’s

• Treats

any gain or loss so recognized as ordinary, and

the character of all items of income, deduction,

• Treats

gain, or

loss with respect to a payment pursuant to the

derivative as ordinary

31