Page 38 - Large Business IRS Training Guides

P. 38

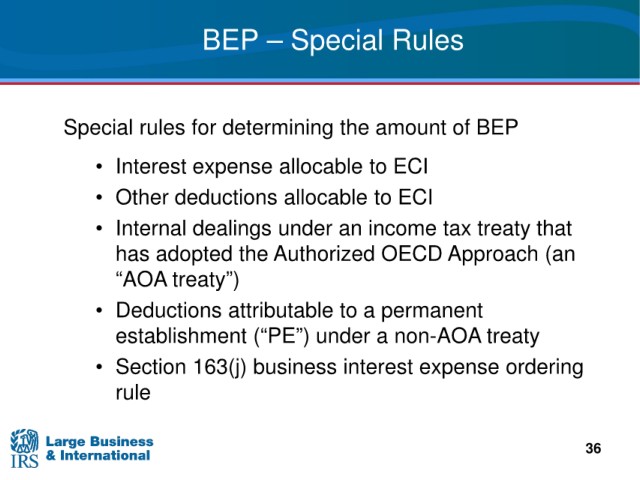

BEP – Special Rules

Special

rules for determining the amount of BEP

• Interest expense allocable to ECI

allocable to ECI

• Other deductions

• Internal dealings

under an income tax treaty that

adopted the Authorized OECD Approach (an

has

“AOA treaty”)

• Deductions

attributable to a permanent

(“PE”) under a non-AOA treaty

establishment

• Section 163(j) business

interest expense ordering

rule

36