Page 40 - Large Business IRS Training Guides

P. 40

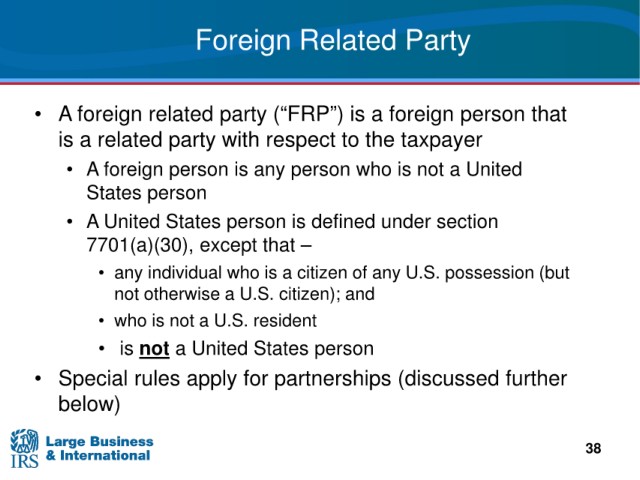

Foreign Related Party

a foreign person that

• A foreign related party (“FRP”) is

with respect to the taxpayer

is a related party

any person who is not a United

• A foreign person is

States person

• A United States person is defined under

section

7701(a)(30), except that –

individual who is a citizen of any U.S. possession (but

• any

otherwise a U.S. citizen); and

not

not a U.S. resident

• who is

• is not a United States person

• Special

rules apply for partnerships (discussed further

below)

38