Page 43 - Large Business IRS Training Guides

P. 43

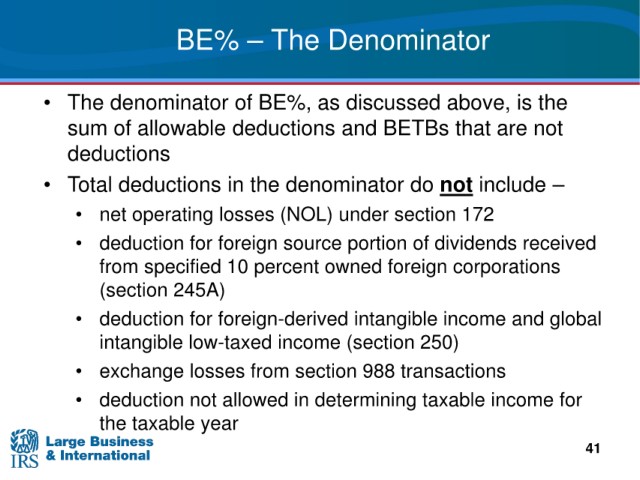

BE%

– The Denominator

• The denominator of

BE%, as discussed above, is the

and BETBs that are not

sum of allowable deductions

deductions

• Total deductions in the denominator do not include –

under section 172

• net operating losses (NOL)

• deduction for

foreign source portion of dividends received

specified 10 percent owned foreign corporations

from

(section 245A)

foreign-derived intangible income and global

• deduction for

intangible low-taxed income (section 250)

• exchange losses

from section 988 transactions

• deduction not allowed in determining taxable income for

the taxable year

41