Page 37 - Large Business IRS Training Guides

P. 37

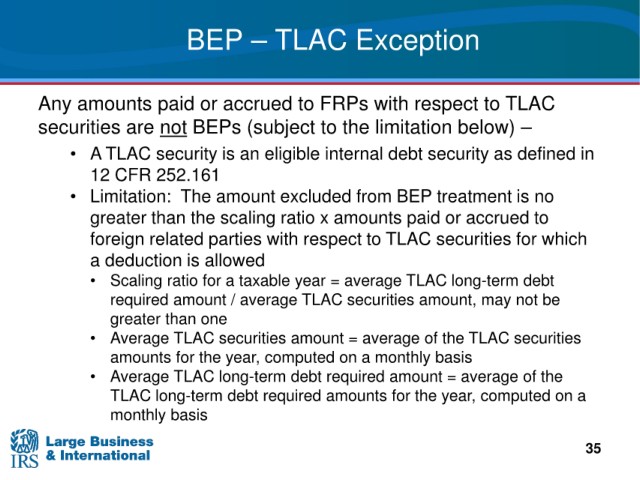

BEP – TLAC

Exception

Any amounts paid or accrued to FRPs with respect to TLAC

securities are not BEPs (subject to the limitation below) –

• A TLAC security is an eligible internal debt security as defined in

252.161

12 CFR

The amount excluded from BEP treatment is no

• Limitation:

greater

than the scaling ratio x amounts paid or accrued to

foreign related parties

with respect to TLAC securities for which

a deduction is

allowed

• Scaling ratio for

a taxable year = average TLAC long-term debt

required amount / average TLAC

securities amount, may not be

than one

greater

amount = average of the TLAC securities

• Average TLAC securities

for the year, computed on a monthly basis

amounts

debt required amount = average of the

• Average TLAC long-term

debt required amounts for the year, computed on a

TLAC long-term

monthly basis

35