Page 335 - Large Business IRS Training Guides

P. 335

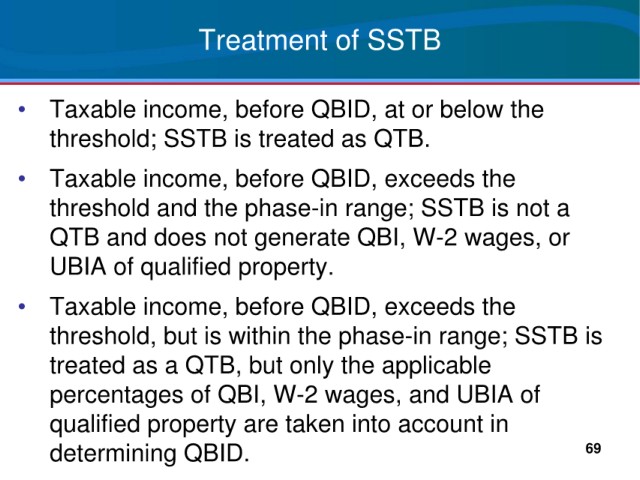

Treatment of SSTB

• Taxable income, before QBID, at or below the

threshold; SSTB is treated as QTB.

• Taxable income, before QBID, exceeds the

threshold and the phase-in range; SSTB is not a

QTB and does not generate QBI, W-2 wages, or

UBIA of qualified property.

• Taxable income, before QBID, exceeds the

threshold, but is within the phase-in range; SSTB is

treated as a QTB, but only the applicable

percentages of QBI, W-2 wages, and UBIA of

qualified property are taken into account in

determining QBID. 69