Page 464 - Large Business IRS Training Guides

P. 464

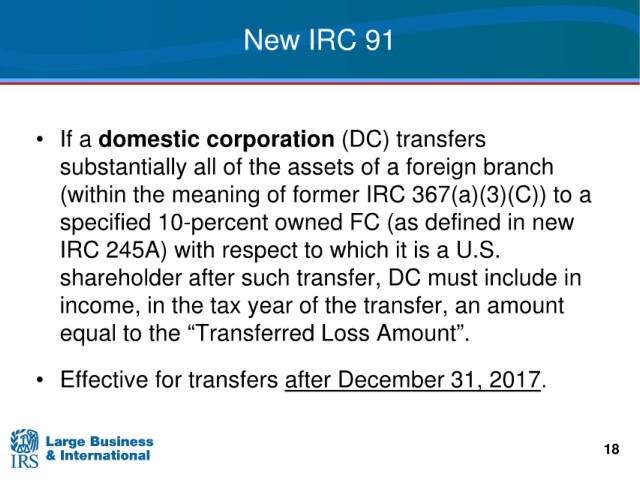

New IRC 91

domestic corporation (DC) transfers

• If a

of the assets of a foreign branch

substantially all

(within the

meaning of former IRC 367(a)(3)(C)) to a

specified 10-percent owned FC (as defined in new

IRC 245A)

with respect to which it is a U.S.

after such transfer, DC must include in

shareholder

income,

in the tax year of the transfer, an amount

to the “Transferred Loss Amount”.

equal

• Effective

for transfers after December 31, 2017.

18