Page 467 - Large Business IRS Training Guides

P. 467

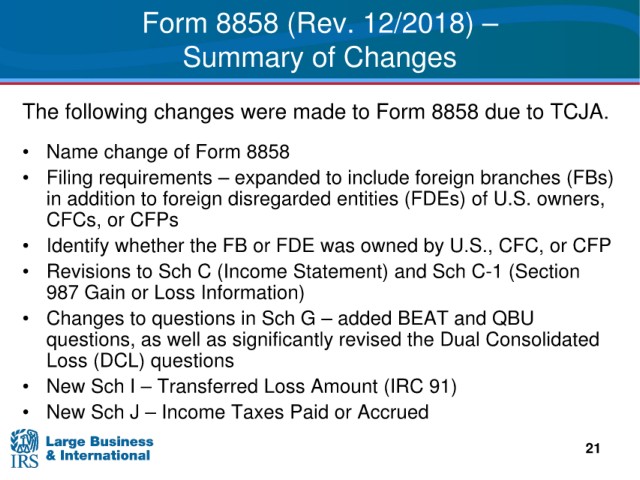

Form 8858 (Rev. 12/2018)

–

Summary of

Changes

The following changes

were made to Form 8858 due to TCJA.

8858

• Name change of Form

• Filing requirements

– expanded to include foreign branches (FBs)

(FDEs) of U.S. owners,

in addition to foreign disregarded entities

CFCs, or CFPs

FDE was owned by U.S., CFC, or CFP

• Identify whether the FB or

• Revisions to Sch C (Income Statement)

and Sch C-1 (Section

987 Gain or Loss Information)

to questions in Sch G – added BEAT and QBU

• Changes

revised the Dual Consolidated

questions, as well as significantly

questions

Loss (DCL)

• New

Sch I – Transferred Loss Amount (IRC 91)

– Income Taxes Paid or Accrued

• New Sch J

21