Page 553 - Large Business IRS Training Guides

P. 553

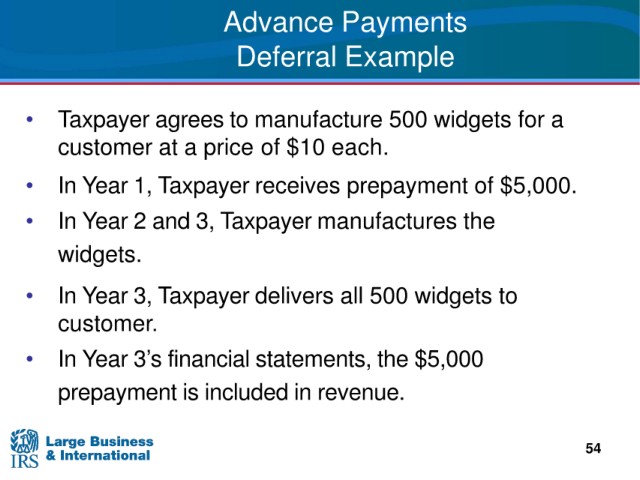

Advance Payments

Deferral Example

• Taxpayer agrees to manufacture 500 widgets for a

customer at a price of $10 each.

• In Year 1, Taxpayer receives prepayment of $5,000.

• In Year 2 and 3, Taxpayer manufactures the

widgets.

• In Year 3, Taxpayer delivers all 500 widgets to

customer.

• In Year 3’s financial statements, the $5,000

prepayment is included in revenue.

54