Page 554 - Large Business IRS Training Guides

P. 554

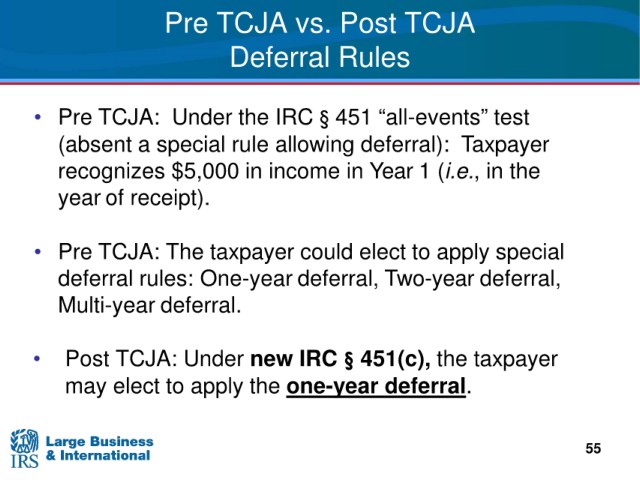

Pre TCJA vs. Post TCJA

Deferral Rules

• Pre TCJA: Under the IRC § 451 “all-events” test

(absent a special rule allowing deferral): Taxpayer

recognizes $5,000 in income in Year 1 (i.e., in the

year of receipt).

• Pre TCJA: The taxpayer could elect to apply special

deferral rules: One-year deferral, Two-year deferral,

Multi-year deferral.

• Post TCJA: Under new IRC § 451(c), the taxpayer

may elect to apply the one-year deferral.

55