Page 604 - Large Business IRS Training Guides

P. 604

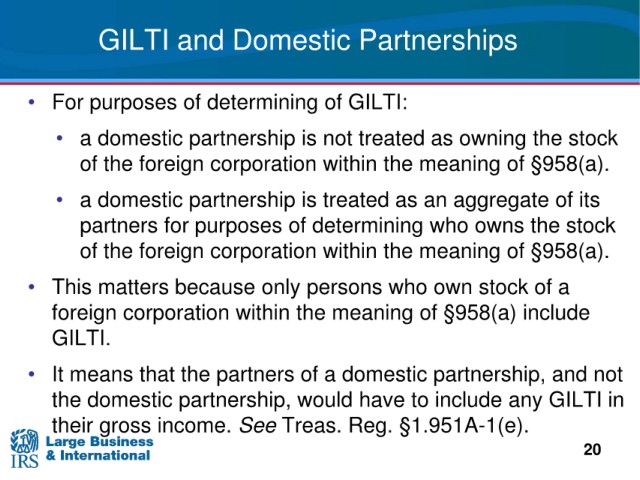

GILTI and Domestic

Partnerships 2

of determining of GILTI:

• For purposes

• a domestic partnership is not treated as

owning the stock

of the foreign corporation within the meaning of

§958(a).

• a domestic partnership is treated as an aggregate of i t s

for purposes of determining who owns the stock

partners

of the foreign corporation within the meaning of

§958(a).

• This

matters because only persons who own stock of a

foreign corporation within the meaning of

§958(a) include

GILTI.

• It means that the partners of a domestic partnership, and not

partnership, would have to include any GILTI in

the domestic

their gross income.

See Treas. Reg. §1.951A-1(e).

20