Page 605 - Large Business IRS Training Guides

P. 605

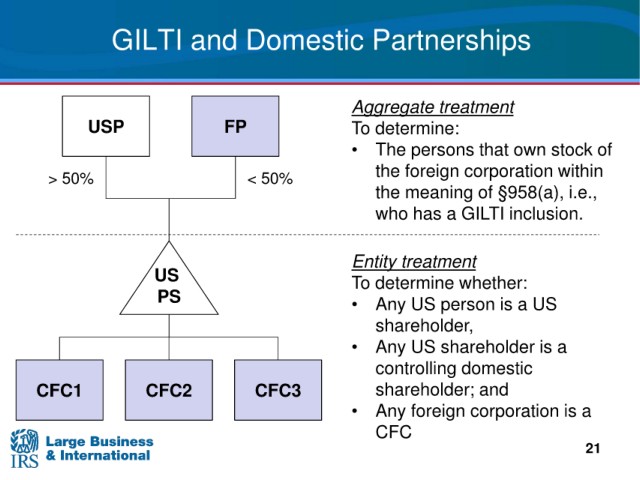

GILTI and Domestic

Partnerships 3

Aggregate treatment

USP

FP

To determine:

• The persons

that own stock of

> 50% < 50% the foreign corporation within

§958(a), i.e.,

the meaning of

who has

a GILTI inclusion.

treatment

Entity

US To determine whether:

PS • Any

US person is a US

shareholder,

US shareholder is a

• Any

controlling domestic

and

CFC1 CFC2 CFC3

shareholder;

• Any

foreign corporation is a

CFC

21