Page 662 - Large Business IRS Training Guides

P. 662

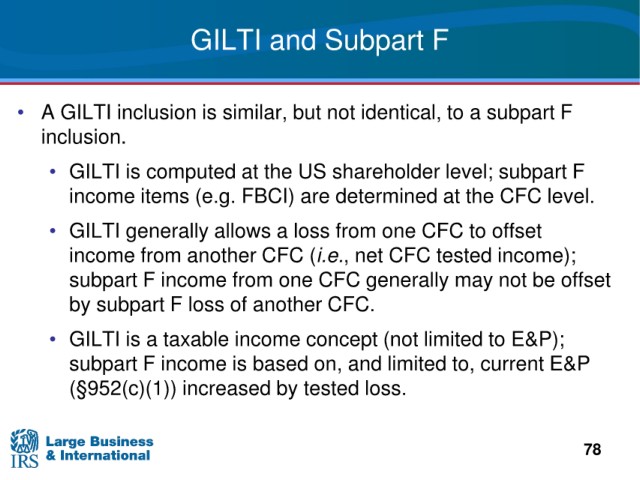

GILTI and Subpart

F

• A GILTI inclusion is similar, but not identical, to a subpart F

inclusion.

computed at the US shareholder level; subpart F

• GILTI is

income items (e.g.

FBCI) are determined at the CFC level.

• GILTI generally

allows a loss from one CFC to offset

income from

another CFC (i.e., net CFC tested income);

subpart

F income from one CFC generally may not be offset

subpart F loss of another CFC.

by

• GILTI i

s a taxable income concept (not limited to E&P);

F income is based on, and limited to, current E&P

subpart

(§952(c)(1))

increased by tested loss.

78