Page 663 - Large Business IRS Training Guides

P. 663

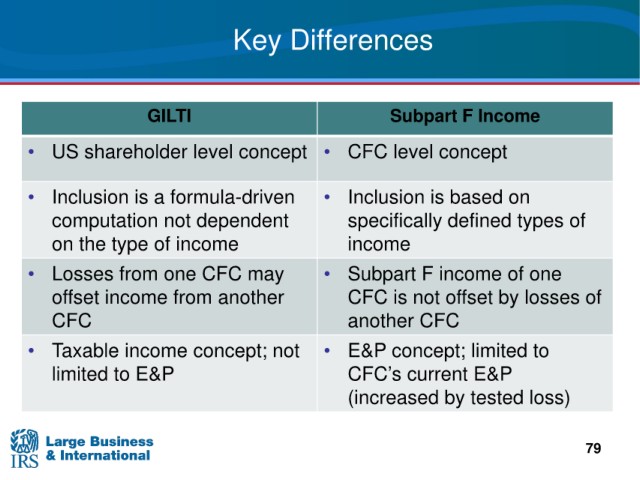

Key

Differences

GILTI Subpart

F Income

level concept • CFC level concept

• US shareholder

• Inclusion is a formula-driven • Inclusion is based on

computation not dependent specifically defined types

of

on the type of income income

• Losses from • Subpart F income of one

one CFC may

is not offset by losses of

offset income from CFC

another

CFC another CFC

concept; limited to

• Taxable income concept; not • E&P

limited to E&P CFC’s current E&P

(increased by

tested loss)

79