Page 95 - Large Business IRS Training Guides

P. 95

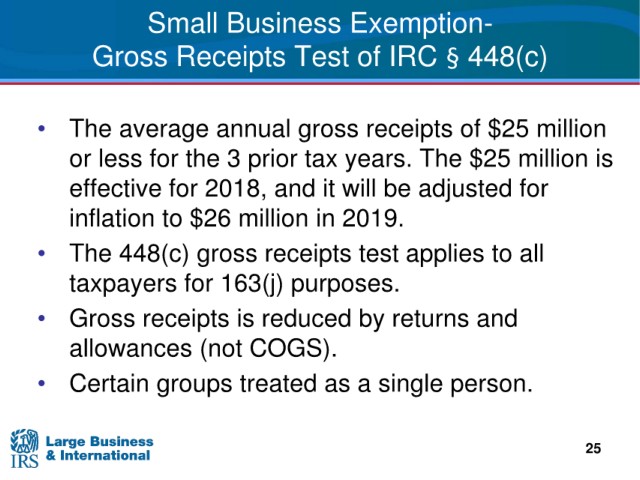

Small Business Exemption-

Gross Receipts Test of IRC § 448(c)

• The average annual gross receipts of $25 million

or less for the 3 prior tax years. The $25 million is

effective for 2018, and it will be adjusted for

inflation to $26 million in 2019.

• The 448(c) gross receipts test applies to all

taxpayers for 163(j) purposes.

• Gross receipts is reduced by returns and

allowances (not COGS).

• Certain groups treated as a single person.

25