Page 96 - Large Business IRS Training Guides

P. 96

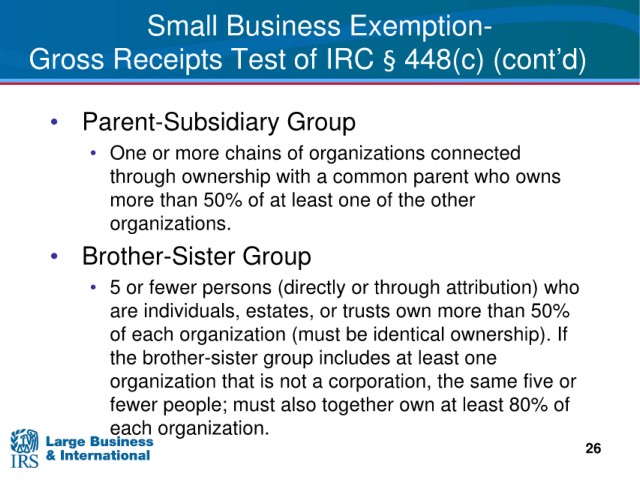

Small Business Exemption-

Gross Receipts Test of IRC § 448(c) (cont’d) 1

• Parent-Subsidiary Group

• One or more chains of organizations connected

through ownership with a common parent who owns

more than 50% of at least one of the other

organizations.

• Brother-Sister Group

• 5 or fewer persons (directly or through attribution) who

are individuals, estates, or trusts own more than 50%

of each organization (must be identical ownership). If

the brother-sister group includes at least one

organization that is not a corporation, the same five or

fewer people; must also together own at least 80% of

each organization.

26