Page 73 - TaxAdviser_Jan_Apr23_Neat

P. 73

TAX CLINIC

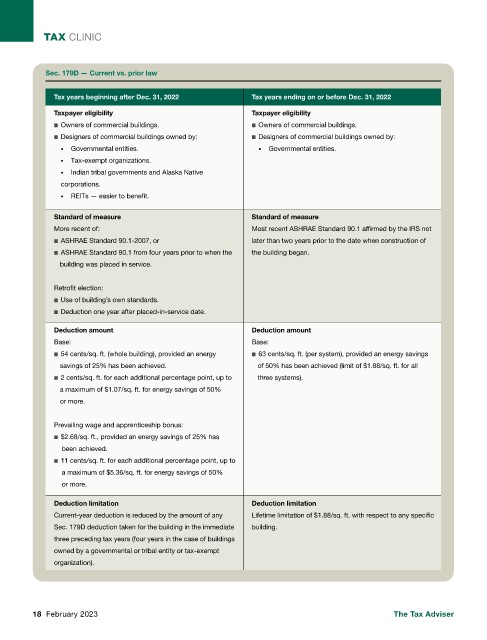

Sec. 179D — Current vs. prior law

Tax years beginning after Dec. 31, 2022 Tax years ending on or before Dec. 31, 2022

Taxpayer eligibility Taxpayer eligibility

■ Owners of commercial buildings. ■ Owners of commercial buildings.

■ Designers of commercial buildings owned by: ■ Designers of commercial buildings owned by:

• Governmental entities. • Governmental entities.

• Tax-exempt organizations.

• Indian tribal governments and Alaska Native

corporations.

• REITs — easier to benefit.

Standard of measure Standard of measure

More recent of: Most recent ASHRAE Standard 90.1 affirmed by the IRS not

■ ASHRAE Standard 90.1-2007, or later than two years prior to the date when construction of

■ ASHRAE Standard 90.1 from four years prior to when the the building began.

building was placed in service.

Retrofit election:

■ Use of building’s own standards.

■ Deduction one year after placed-in-service date.

Deduction amount Deduction amount

Base: Base:

■ 54 cents/sq. ft. (whole building), provided an energy ■ 63 cents/sq. ft. (per system), provided an energy savings

savings of 25% has been achieved. of 50% has been achieved (limit of $1.88/sq. ft. for all

■ 2 cents/sq. ft. for each additional percentage point, up to three systems).

a maximum of $1.07/sq. ft. for energy savings of 50%

or more.

Prevailing wage and apprenticeship bonus:

■ $2.68/sq. ft., provided an energy savings of 25% has

been achieved.

■ 11 cents/sq. ft. for each additional percentage point, up to

a maximum of $5.36/sq. ft. for energy savings of 50%

or more.

Deduction limitation Deduction limitation

Current-year deduction is reduced by the amount of any Lifetime limitation of $1.88/sq. ft. with respect to any specific

Sec. 179D deduction taken for the building in the immediate building.

three preceding tax years (four years in the case of buildings

owned by a governmental or tribal entity or tax-exempt

organization).

18 February 2023 The Tax Adviser