Page 21 - 2021 Taxes Quick Guide_01

P. 21

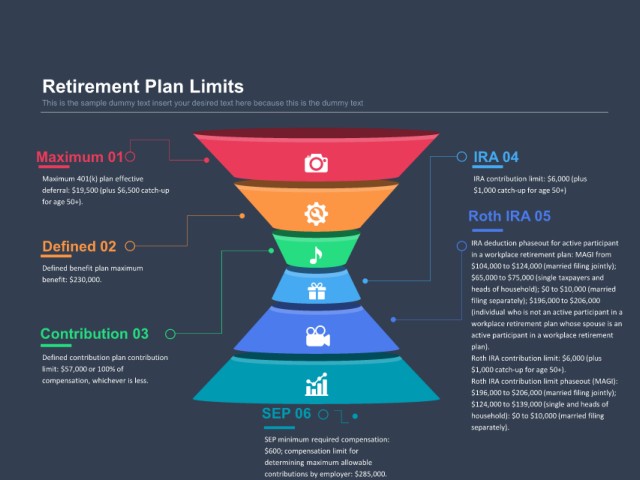

Retirement Plan Limits

This is the sample dummy text insert your desired text here because this is the dummy text

Maximum 01 IRA 04

Maximum 401(k) plan effective IRA contribution limit: $6,000 (plus

deferral: $19,500 (plus $6,500 catch-up $1,000 catch-up for age 50+)

for age 50+).

Roth IRA 05

Defined 02 IRA deduction phaseout for active participant

in a workplace retirement plan: MAGI from

Defined benefit plan maximum $104,000 to $124,000 (married filing jointly);

benefit: $230,000. $65,000 to $75,000 (single taxpayers and

heads of household); $0 to $10,000 (married

filing separately); $196,000 to $206,000

(individual who is not an active participant in a

workplace retirement plan whose spouse is an

Contribution 03 active participant in a workplace retirement

plan).

Defined contribution plan contribution Roth IRA contribution limit: $6,000 (plus

limit: $57,000 or 100% of $1,000 catch-up for age 50+).

compensation, whichever is less. Roth IRA contribution limit phaseout (MAGI):

$196,000 to $206,000 (married filing jointly);

SEP 06 $124,000 to $139,000 (single and heads of

household): $0 to $10,000 (married filing

separately).

SEP minimum required compensation:

$600; compensation limit for

determining maximum allowable

contributions by employer: $285,000.