Page 118 - International Taxation IRS Training Guides

P. 118

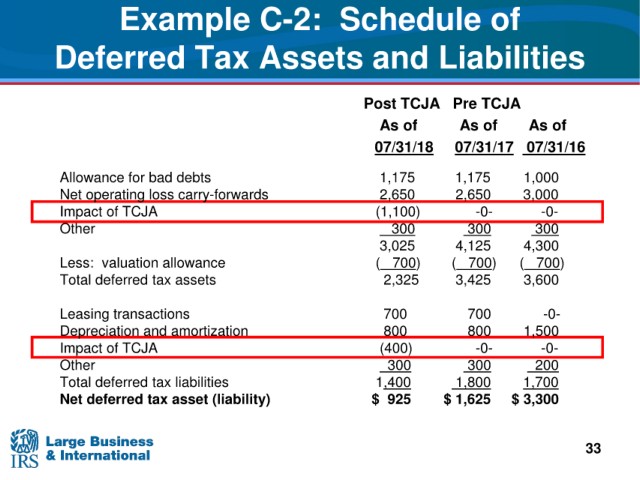

Example C-2:

Schedule of

Deferred

Tax Assets and Liabilities

Post Pre TCJA

TCJA

f

As As of As of

o

07/31/18 07/31/17 07/31/16

Allowance for bad debts 1,175 1,175 1,000

Net operating loss carry-forwards 2,650 2,650 3,000

Impact of TCJA (1,100) -0 -0

Other 300 300 300

3,025 4,125 4,300

Less: valuation allowance ( 700) ( 700) ( 700)

Total deferred tax assets 2,325 3,425 3,600

Leasing transactions 700 700 -0

Depreciation and amortization 800 800 1,500

Impact of TCJA (400) -0 -0

Other 300 300 200

Total deferred tax liabilities 1,400 1,800 1,700

Net deferred $ 925 $ 1,625 $ 3,300

tax asset (liability)

33