Page 113 - International Taxation IRS Training Guides

P. 113

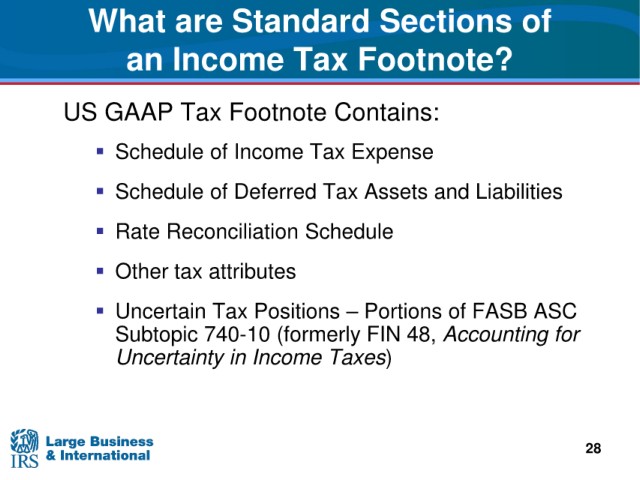

What are Standard

Sections of

an Income

Tax Footnote?

US GAAP Tax Footnote Contains:

Expense

Schedule of Income Tax

Schedule of

Deferred Tax Assets and Liabilities

Rate Reconciliation Schedule

Other tax

attributes

Uncertain Tax Positions

– Portions of FASB ASC

Subtopic 740-10 (formerly FIN

48, Accounting for

Uncertainty

in Income Taxes)

28