Page 108 - International Taxation IRS Training Guides

P. 108

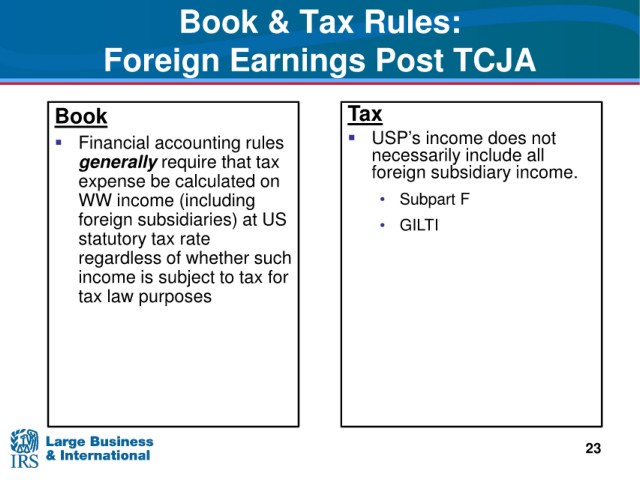

Book & Tax Rules:

Foreign Earnings Post

TCJA

Book Tax

income does not

Financial USP’s

accounting rules

include all

generally require that necessarily

tax

income.

expense be calculated on foreign subsidiary

income (including

WW • Subpart F

at US

foreign subsidiaries) • GILTI

statutory

tax rate

regardless

of whether such

subject to tax for

income is

law purposes

tax

23