Page 103 - International Taxation IRS Training Guides

P. 103

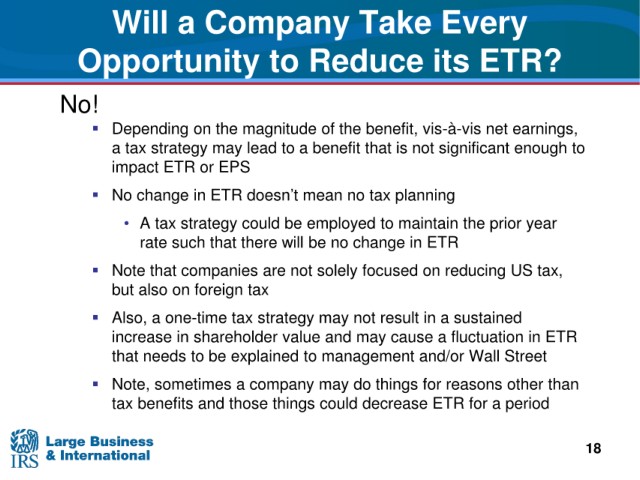

Will

a Company Take Every

Opportunity

to Reduce its ETR?

No!

the benefit, vis-à-vis net earnings,

Depending on the magnitude of

strategy may lead to a benefit that is not significant enough to

a tax

or EPS

impact ETR

No change in ETR

doesn’t mean no tax planning

• A tax strategy

could be employed to maintain the prior year

rate such that there will

be no change in ETR

are not solely focused on reducing US tax,

Note that companies

but also on foreign tax

strategy may not result in a sustained

Also, a one-time tax

value and may cause a fluctuation in ETR

increase in shareholder

needs to be explained to management and/or Wall Street

that

Note,

sometimes a company may do things for reasons other than

and those things could decrease ETR for a period

tax benefits

18