Page 107 - International Taxation IRS Training Guides

P. 107

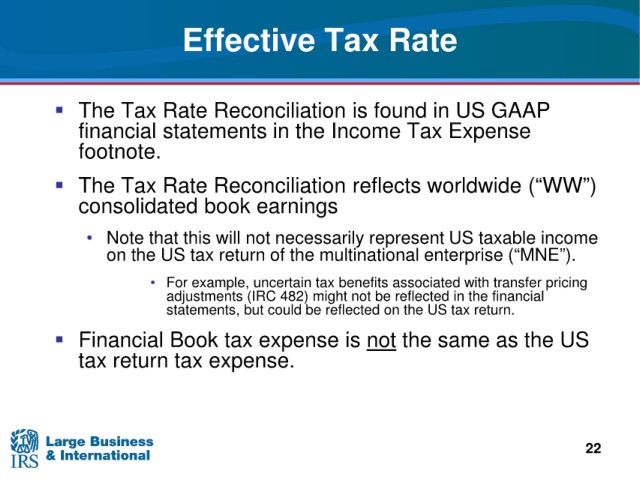

Effective Tax Rate

Rate Reconciliation is found in US GAAP

The Tax

statements in the Income Tax Expense

financial

footnote.

The Tax

Rate Reconciliation reflects worldwide (“WW”)

consolidated book earnings

this will not necessarily represent US taxable income

• Note that

tax return of the multinational enterprise (“MNE”).

on the US

example, uncertain tax benefits associated with transfer pricing

• For

(IRC 482) might not be reflected in the financial

adjustments

tax return.

statements, but could be reflected on the US

Financial Book tax expense is not the same as the US

tax return tax expense.

22