Page 111 - International Taxation IRS Training Guides

P. 111

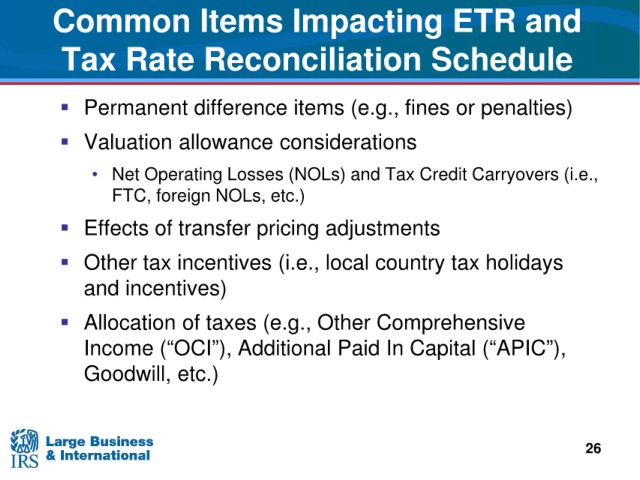

Common Items Impacting ETR and

Tax

Rate Reconciliation Schedule

difference items (e.g., fines or penalties)

Permanent

Valuation allowance considerations

• Net

Operating Losses (NOLs) and Tax Credit Carryovers (i.e.,

foreign NOLs, etc.)

FTC,

pricing adjustments

Effects of transfer

Other

tax incentives (i.e., local country tax holidays

and incentives)

Allocation of

taxes (e.g., Other Comprehensive

Income (“OCI”), Additional

Paid In Capital (“APIC”),

Goodwill, etc.)

26