Page 150 - International Taxation IRS Training Guides

P. 150

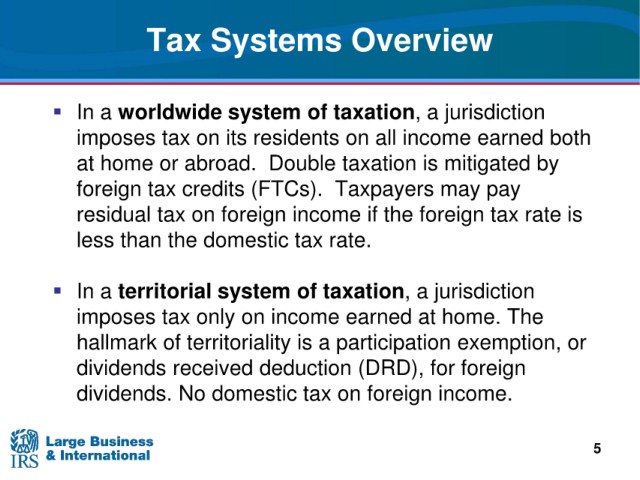

Tax Systems Overview

taxation, a jurisdiction

In a worldwide system of

on its residents on all income earned both

imposes tax

at home or abroad. Double taxation is mitigated by

(FTCs).

foreign tax credits Taxpayers may pay

tax on foreign income if the foreign tax rate is

residual

less than the domestic tax rate.

taxation, a jurisdiction

In a territorial system of

only on income earned at home. The

imposes tax

territoriality is a participation exemption, or

hallmark of

received deduction (DRD), for foreign

dividends

dividends.

No domestic tax on foreign income.

5