Page 154 - International Taxation IRS Training Guides

P. 154

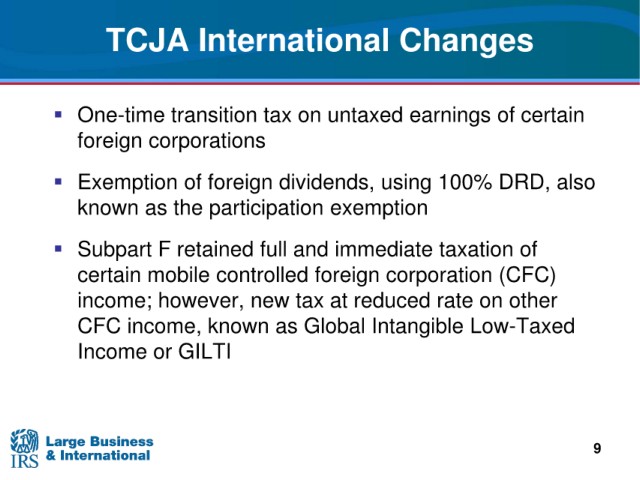

TCJA International Changes

One-time transition tax on untaxed earnings of

certain

foreign corporations

foreign dividends, using 100% DRD, also

Exemption of

the participation exemption

known as

F retained full and immediate taxation of

Subpart

certain mobile controlled foreign corporation (CFC)

income; however,

new tax at reduced rate on other

known as Global Intangible Low-Taxed

CFC income,

Income or

GILTI

9