Page 156 - International Taxation IRS Training Guides

P. 156

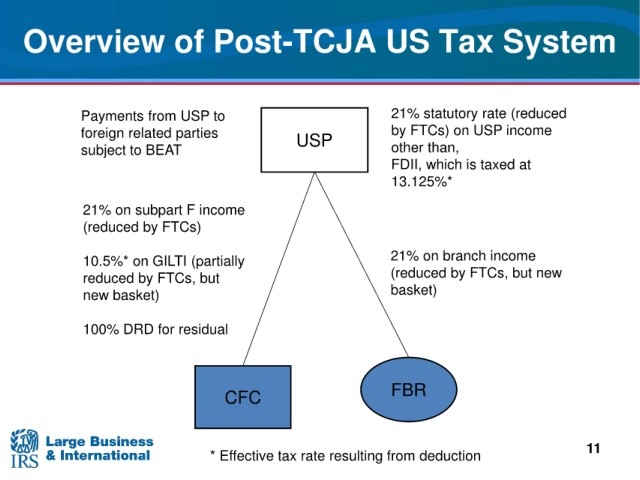

Overview of Post-TCJA US Tax System

Payments from USP to 21% statutory rate (reduced

foreign related parties USP by FTCs) on USP income

subject to BEAT other than,

FDII, which is

taxed at

13.125%*

21% on subpart F income

(reduced by FTCs)

10.5%* on GILTI (partially 21% on branch income

FTCs, but new

reduced by (reduced by

FTCs, but

new basket) basket)

DRD for residual

100%

CFC FBR

* Effective tax rate resulting from deduction 11