Page 171 - International Taxation IRS Training Guides

P. 171

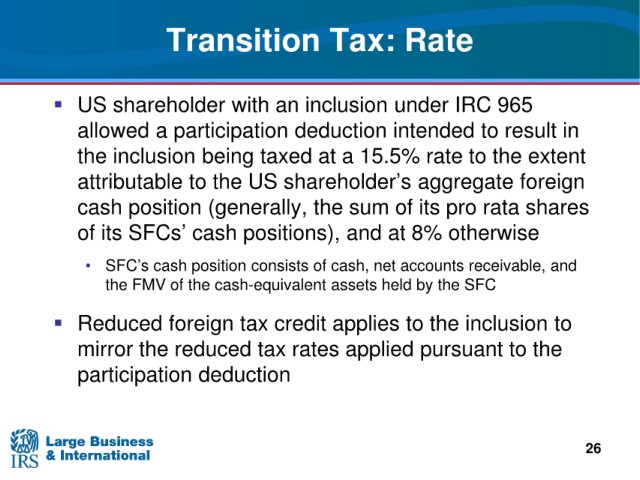

Transition Tax: Rate

with an inclusion under IRC 965

US shareholder

allowed a participation deduction intended to result in

rate to the extent

the inclusion being taxed at a 15.5%

shareholder’s aggregate foreign

attributable to the US

cash position (generally,

the sum of its pro rata shares

SFCs’ cash positions), and at 8% otherwise

of i t s

and

• SFC’s cash position consists of cash, net accounts receivable,

the FMV

of the cash-equivalent assets held by the SFC

Reduced foreign tax credit applies to the inclusion to

mirror the reduced tax rates applied pursuant to the

participation deduction

26