Page 173 - International Taxation IRS Training Guides

P. 173

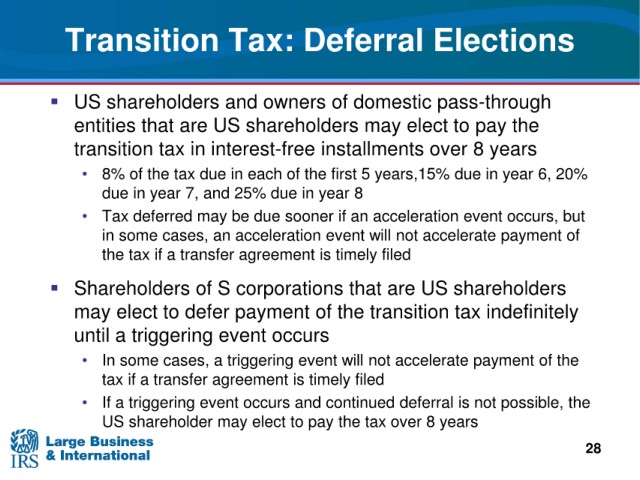

Transition

Tax: Deferral Elections

and owners of domestic pass-through

US shareholders

that are US shareholders may elect to pay the

entities

transition tax

in interest-free installments over 8 years

due in each of the first 5 years,15% due in year 6, 20%

• 8% of the tax

due in year

7, and 25% due in year 8

• Tax deferred may

be due sooner if an acceleration event occurs, but

not accelerate payment of

in some cases, an acceleration event will

a transfer agreement is timely filed

the tax i f

Shareholders

of S corporations that are US shareholders

may

elect to defer payment of the transition tax indefinitely

a triggering event occurs

until

• In some cases, a triggering event will

not accelerate payment of the

a transfer agreement is timely filed

tax i f

• If a triggering event occurs and continued deferral is not possible, the

US shareholder

may elect to pay the tax over 8 years

28