Page 186 - International Taxation IRS Training Guides

P. 186

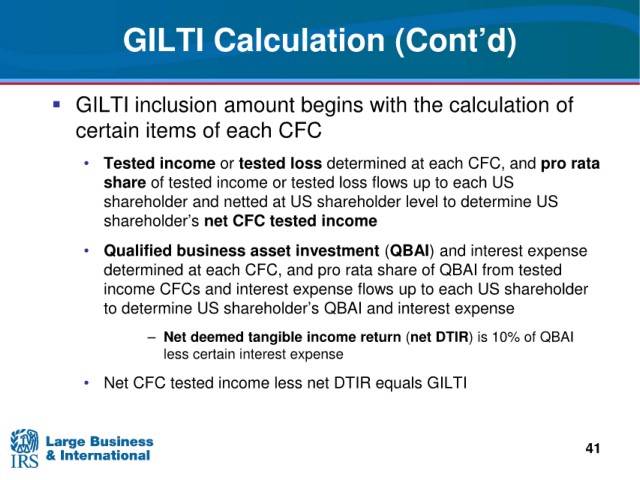

GILTI Calculation (Cont’d)

inclusion amount begins with the calculation of

GILTI

each CFC

certain items of

tested loss determined at each CFC, and pro rata

• Tested income or

tested income or tested loss flows up to each US

share of

and netted at US shareholder level to determine US

shareholder

shareholder’s

net CFC tested income

• Qualified business asset

investment (QBAI) and interest expense

each CFC, and pro rata share of QBAI from tested

determined at

up to each US shareholder

income CFCs and interest expense flows

to determine US shareholder’s

QBAI and interest expense

income return (net DTIR) is 10% of QBAI

– Net deemed tangible

less certain interest expense

• Net CFC tested income less net DTIR

equals GILTI

41