Page 181 - International Taxation IRS Training Guides

P. 181

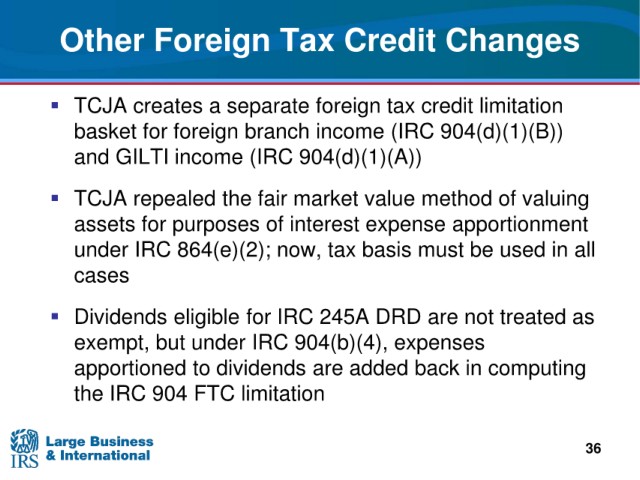

Other Foreign Tax Credit Changes

TCJA creates a separate foreign tax credit limitation

basket

for foreign branch income (IRC 904(d)(1)(B))

and GILTI

income (IRC 904(d)(1)(A))

TCJA

repealed the fair market value method of valuing

assets for purposes

of interest expense apportionment

under

IRC 864(e)(2); now, tax basis must be used in all

cases

eligible for IRC 245A DRD are not treated as

Dividends

but under IRC 904(b)(4), expenses

exempt,

are added back in computing

apportioned to dividends

the IRC 904 FTC limitation

36