Page 180 - International Taxation IRS Training Guides

P. 180

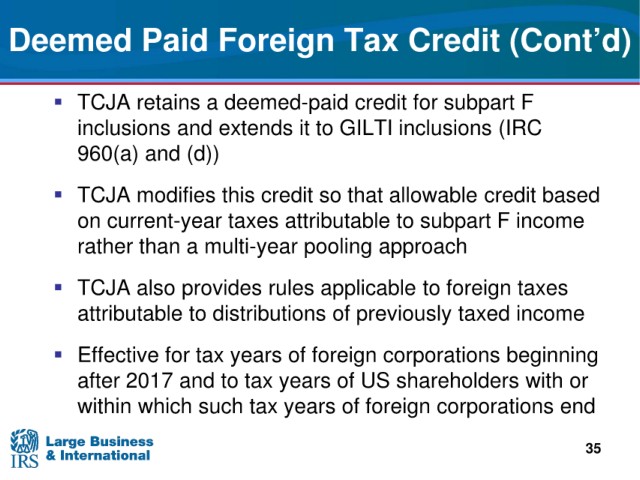

Deemed Paid Foreign Tax Credit (Cont’d)

subpart F

TCJA retains a deemed-paid credit for

inclusions

and extends it to GILTI inclusions (IRC

960(a) and (d))

TCJA

modifies this credit so that allowable credit based

F income

on current-year taxes attributable to subpart

than a multi-year pooling approach

rather

TCJA also provides

rules applicable to foreign taxes

of previously taxed income

attributable to distributions

tax years of foreign corporations beginning

Effective for

2017 and to tax years of US shareholders with or

after

within which such tax

years of foreign corporations end

35