Page 179 - International Taxation IRS Training Guides

P. 179

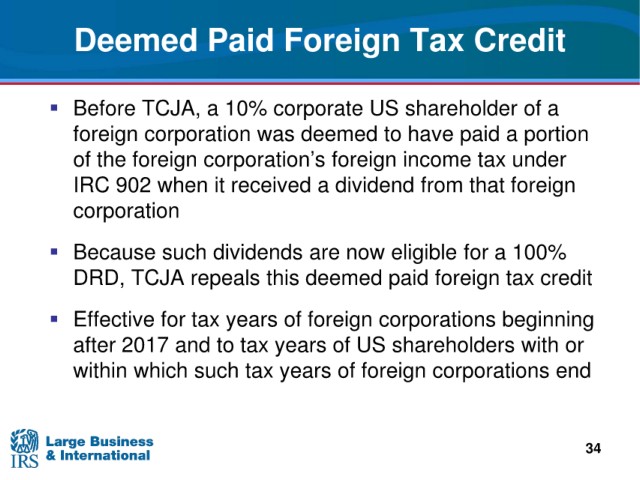

Deemed

Paid Foreign Tax Credit

Before TCJA,

a 10% corporate US shareholder of a

foreign corporation was deemed to have paid a portion

the foreign corporation’s foreign income tax under

of

902 when it received a dividend from that foreign

IRC

corporation

are now eligible for a 100%

Because such dividends

TCJA repeals this deemed paid foreign tax credit

DRD,

Effective for

tax years of foreign corporations beginning

after

2017 and to tax years of US shareholders with or

years of foreign corporations end

within which such tax

34