Page 20 - International Taxation IRS Training Guides

P. 20

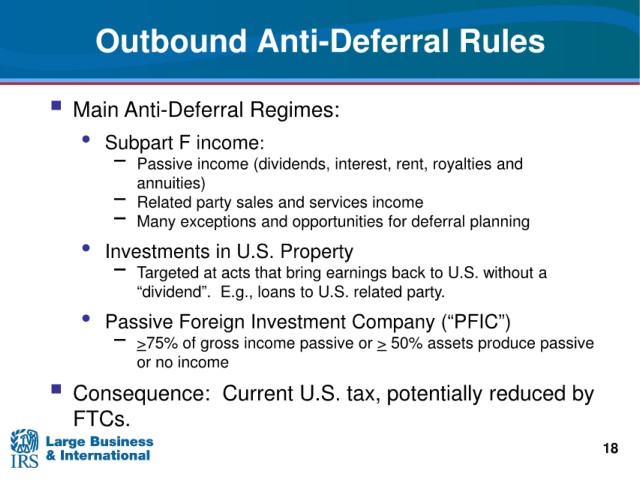

Outbound Anti-Deferral Rules

Main Anti-Deferral Regimes:

• Subpart F income:

− Passive income (dividends, interest, rent, royalties and

annuities)

− Related party

sales and services income

− Many exceptions and opportunities for deferral planning

in U.S. Property

• Investments

that bring earnings back to U.S. without a

− Targeted at acts

“dividend”.

E.g., loans to U.S. related party.

• Passive Foreign Investment Company (“PFIC”)

− >75% of gross income passive or > 50% assets produce passive

or no income

Consequence: Current U.S. tax, potentially reduced by

FTCs.

18