Page 21 - International Taxation IRS Training Guides

P. 21

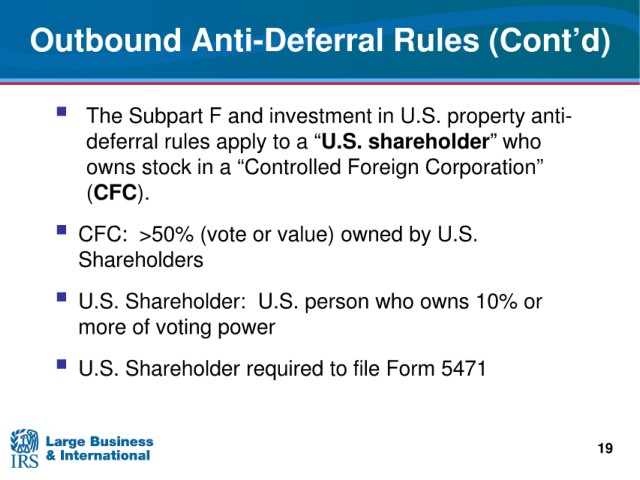

Outbound Anti-Deferral Rules

(Cont’d)

in U.S. property anti-

The Subpart F and investment

deferral rules

apply to a “U.S. shareholder” who

owns stock

in a “Controlled Foreign Corporation”

(CFC).

>50% (vote or value) owned by U.S.

CFC:

Shareholders

U.S. person who owns 10% or

U.S. Shareholder:

more of voting power

U.S. Shareholder

required to file Form 5471

19