Page 203 - International Taxation IRS Training Guides

P. 203

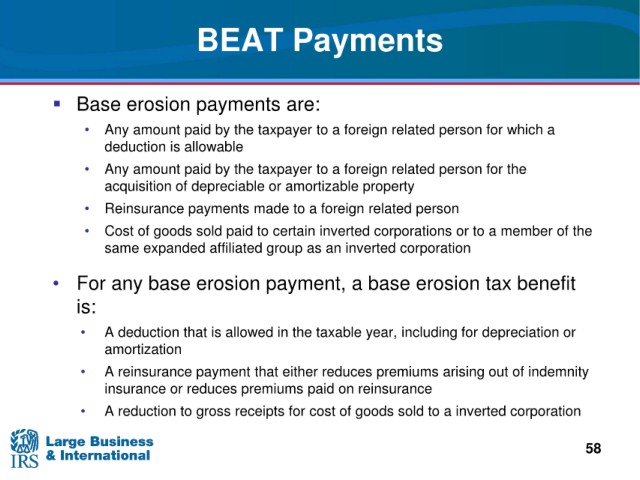

BEAT Payments

Base erosion payments

are:

amount paid by the taxpayer to a foreign related person for which a

• Any

deduction is allowable

• Any

amount paid by the taxpayer to a foreign related person for the

acquisition of depreciable or amortizable property

• Reinsurance payments made to a foreign related person

sold paid to certain inverted corporations or to a member of the

• Cost of goods

same expanded affiliated group as an inverted corporation

any base erosion payment, a base erosion tax benefit

• For

is:

• A deduction that is

allowed in the taxable year, including for depreciation or

amortization

• A reinsurance payment that either reduces premiums arising out of indemnity

insurance or reduces premiums paid on reinsurance

• A reduction to gross receipts for cost of goods sold to a inverted corporation

58