Page 225 - International Taxation IRS Training Guides

P. 225

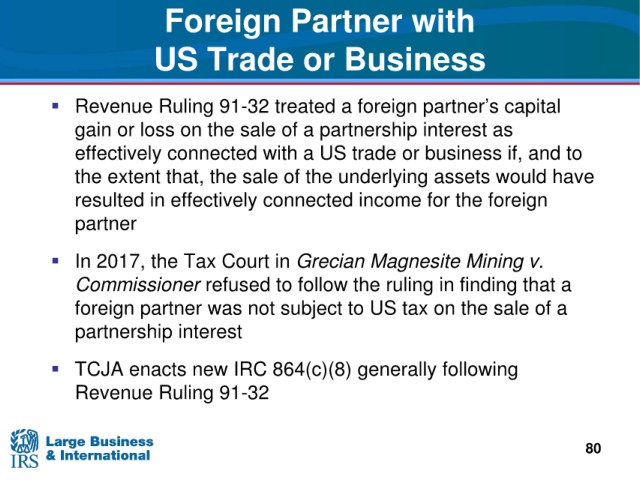

Foreign Partner with

US Trade or Business

capital

Revenue Ruling 91-32 treated a foreign partner’s

gain or loss on the sale of a partnership interest as

connected with a US trade or business if, and to

effectively

would have

the extent that, the sale of the underlying assets

resulted in effectively

connected income for the foreign

partner

In 2017, the Tax Court in Grecian Magnesite Mining v.

the ruling in finding that a

Commissioner refused to follow

foreign partner

was not subject to US tax on the sale of a

partnership interest

TCJA enacts new

IRC 864(c)(8) generally following

Revenue Ruling 91-32

80