Page 222 - International Taxation IRS Training Guides

P. 222

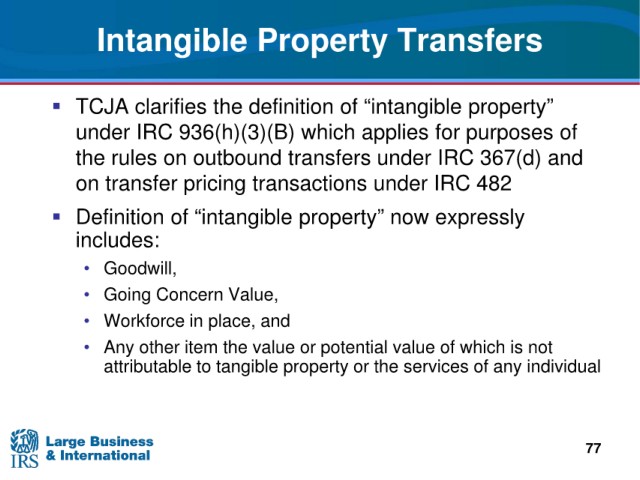

Intangible

Property Transfers

TCJA

clarifies the definition of “intangible property”

IRC 936(h)(3)(B) which applies for purposes of

under

on outbound transfers under IRC 367(d) and

the rules

on transfer

pricing transactions under IRC 482

Definition of “intangible property” now

expressly

includes:

• Goodwill,

• Going Concern Value,

• Workforce

in place, and

• Any

other item the value or potential value of which is not

the services of any individual

attributable to tangible property or

77